Tag: TEPCO

-

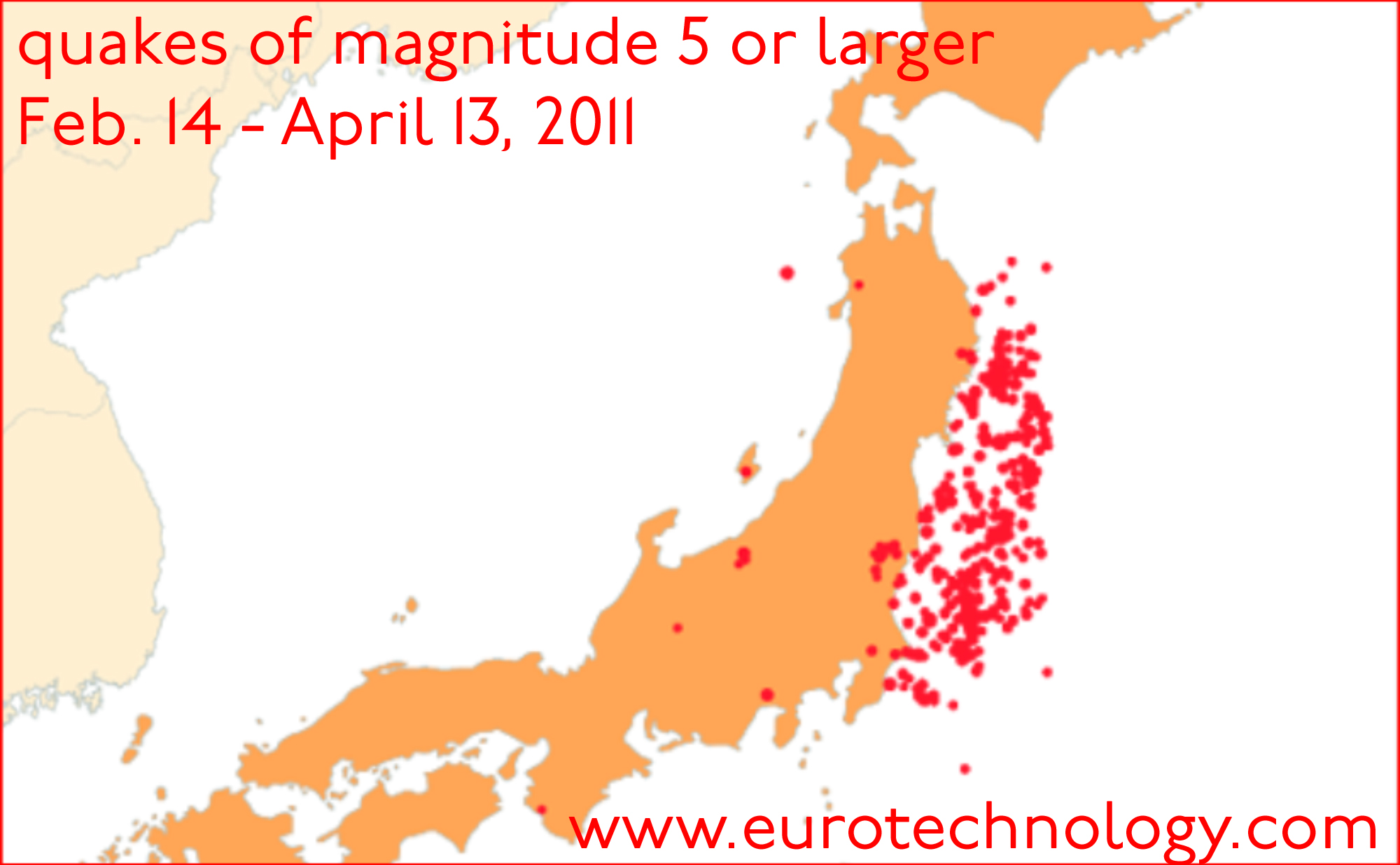

Fukushima nuclear disaster: 5 years since the Tohoku earthquake and tsunami on 2011/3/11 at 14:46:24

5 years and many lessons learnt since the Tohoku and Fukushima disasters Tohoku disaster and Fukushima nuclear disaster lead to Japan’s energy market liberalization Tohoku disaster: On Friday March 11, 2011 at 14:46:24, the magnitude 9.0 “Great East Japan earthquake” caused a tsunami, reaching up to 40.4 meters high inland in Tohoku. Japan’s National Police…

-

Japan electricity sector disruption – new business models and deregulation overdue

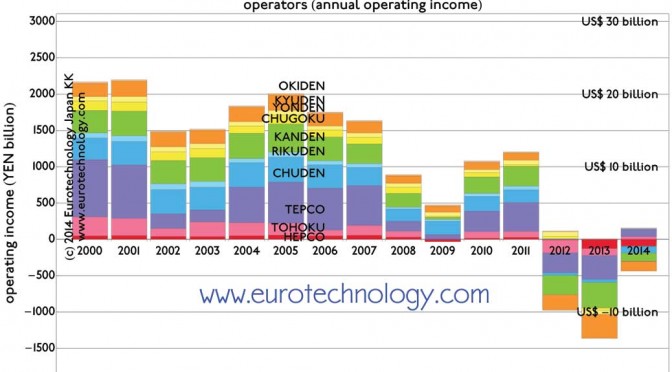

Japan electricity regional operators’ income peaked about 10 years ago Japanese electricity companies’ business models face massive disruption by technology innovation and the Fukushima nuclear accident With the annual general shareholder meetings completed and financial results published, we have analyzed the financial results of Japan’s 10 regional electric power companies (plus several other Japanese electricity…

-

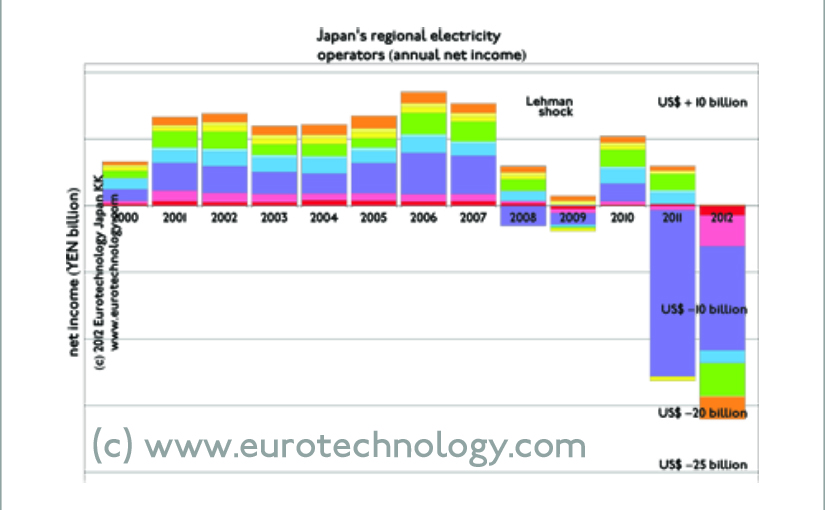

US$ 15 billion losses for Japan’s electricity sector continue

On April 30 Japan’s electricity operators announced their financial results for the financial year that ended on March 31. Japan’s ten regional electricity operators again announced combined net losses in excess of US$ 15 billion for the Financial Year ending March 31, 2013, similar in size as the previous year: energy remains one of Japan’s…

-

Financial instability of Japan’s electricity companies started in 2007

Financial instability of Japan’s electricity companies started long before the Fukushima nuclear accident Japan’s electricity companies ran into financial instability long before the March 11, 2011 disaster It is often assumed that the financial difficulties of Japan’s electricity companies are caused by the shut-down of almost all Japanese nuclear power stations within 13 months of…

-

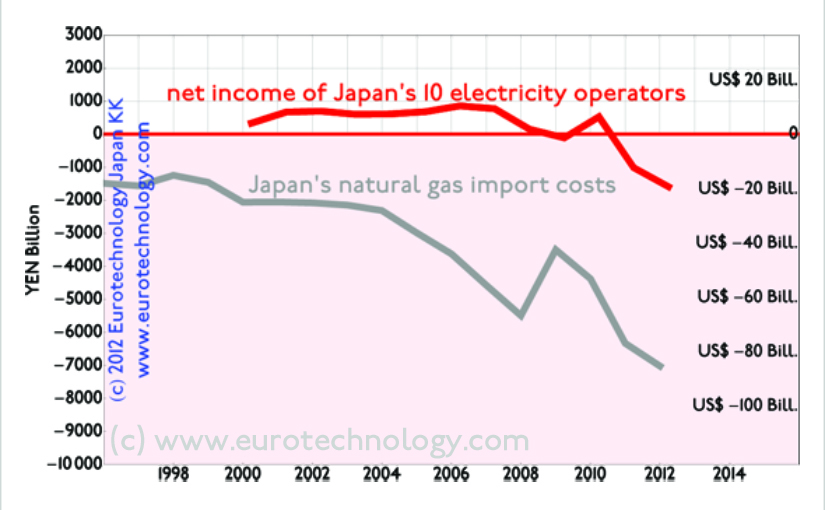

Japan’s electricity industry suffers huge losses from nuclear to fossil switch

What is the financial impact of Japan’s switch from nuclear to fossil on Japan’s electricity industry? Japan’s electricity operators switched from profits to huge losses What is the financial impact of Japan’s switch from nuclear to fossil on Japan’s electricity industry? Answer: Japan’s electricity operators switched from about US$ 10 billion/year combined net profits to…

-

KDDI may partner with Poweredcom/TEPCO

Poweredcom has doubled investments in FTTH to YEN 44 Billion (US$ 0.4 Billion) for FY 2005/2006 from YEN 22 Billion in FY 2204/2005. (For details and analysis of Japan’s FTTH market read our report on Japan’s telecom sector). Partnership with KDDI‘s triple-play leverages Poweredcom’s present and future FTTH investments. Copyright·©1997-2013 ·Eurotechnology Japan KK·All Rights Reserved·