Tag: Konami

-

Japan iPhone AppStore: 10 out of the 25 top grossing apps in Japan are by companies of foreign origin. Can you guess which?

Japan is No. 1 globally in terms of iOS AppStore + Google Play revenues, bigger and faster growing than USA 10 out of 25 top grossing apps in Japan are of foreign origin Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is…

-

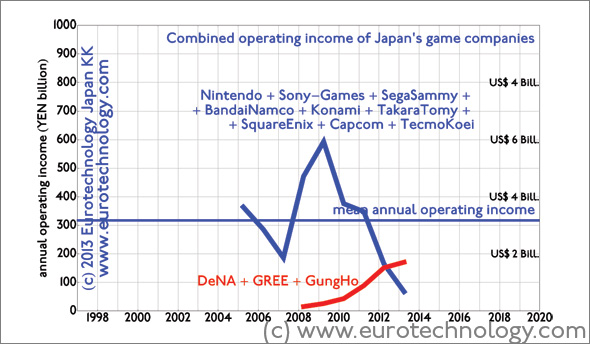

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…