Tag: murata

-

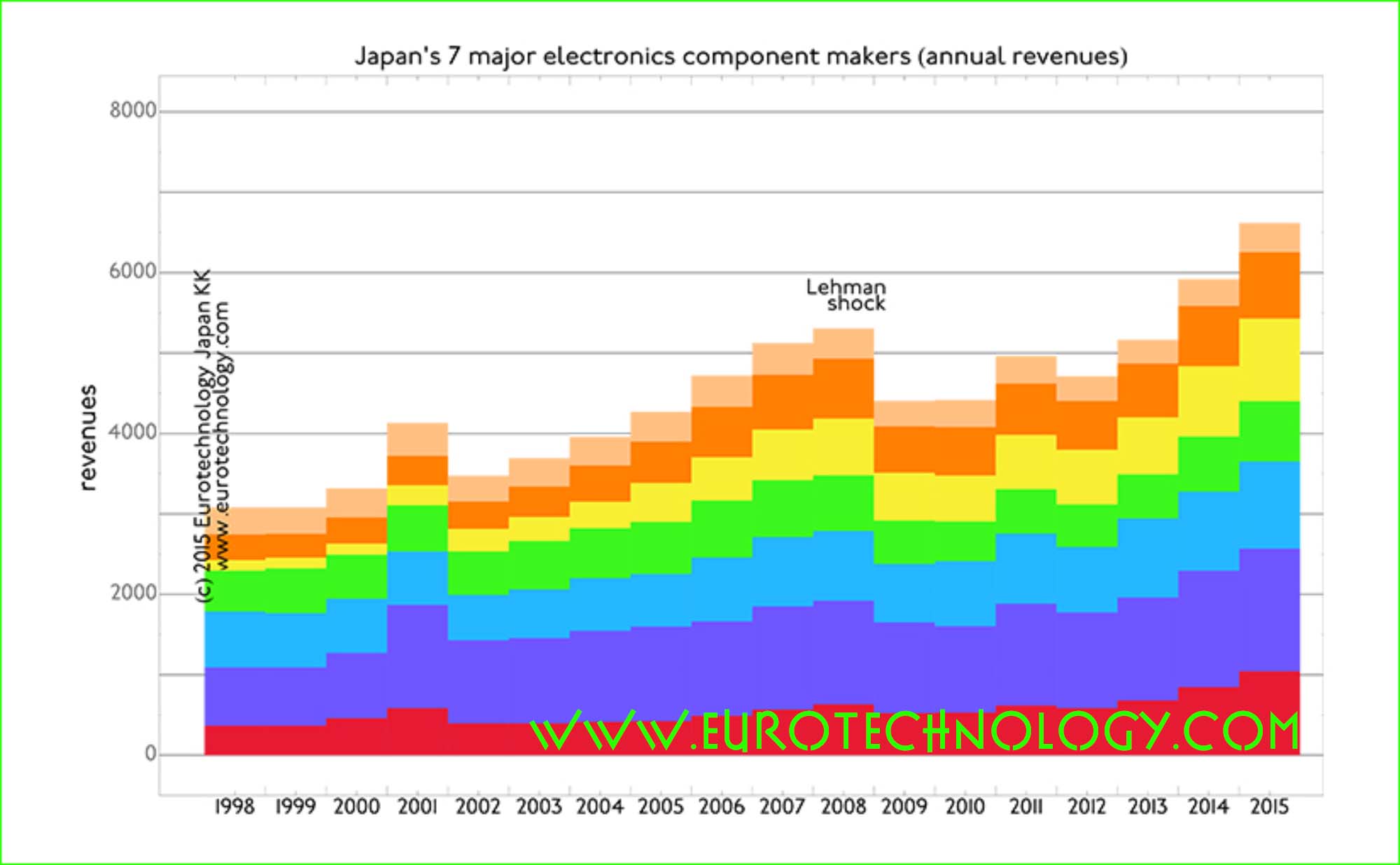

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

Murata cheerleader robots: stability, sensing, synchronized dance – waiting for open innovation and APIs?

Murata and its robots Murata introduced their newest Cheerleader robots in a press event on September 25, 2014 in Tokyo.Purpose of the robots is brand building and advertising of the company’s components and capabilities. Watch the Cheerleader robots dance synchronously here: Murata Manufacturing (村田製作所) While Japan’s eight electronics conglomerates stagnate in both revenues and income…