Search results for: “galapagos”

-

Japan’s Galapagos Effect

How Japan can capture global value from its innovations – a talk by Gerhard Fasol Dr. Gerhard Fasol dissects the history behind Japan’s unique international market separation By Hugh Ashton Originally published both in the print and online editions of the ACCJ Journal (Journal of the American Chamber of Commerce in Japan) on January 15,…

-

Japan Galapagos effect (Galapagos syndrome)

Japan Galapagos effect Autor: Gerhard Fasol Globalizing Japan On the Galapagos islands, Charles Darwin noticed a number of species which were extremely beautiful, had evolved on the Galapagos islands locally, and were not able to live anywhere else. Similarly, due to language, culture, comparatively small interchange between Japan’s markets and foreign markets, some technologies and…

-

Galapagos effect: how can Japan capture global value from Japan’s technologies and new business models?

—

by

Japan develops fantastic technologies and new business models and often fails to capture global value by Gerhard Fasol Galapagos effect (Galapagos syndrome) On the Galapagos islands, Charles Darwin noticed a number of species which were extremely beautiful, had evolved on the Galapagos islands locally, and were not able to live anywhere else. Similarly, due to…

-

How to turn Galapagos into a competitive advantage in both directions

Positive and negative aspects of Japan’s Galapagos issues European Institute of Japanese Studies Academy Seminars presents Speaker: Dr. Gerhard Fasol, President, Eurotechnology Japan K.K. Wednesday, June 13, 2012, 18:30 – 21:00 Embassy of Sweden, Alfred Nobel Auditorium Stockholm School of Economics, European Institute of Japanese Studies About the talk: In the last 20 years, several…

-

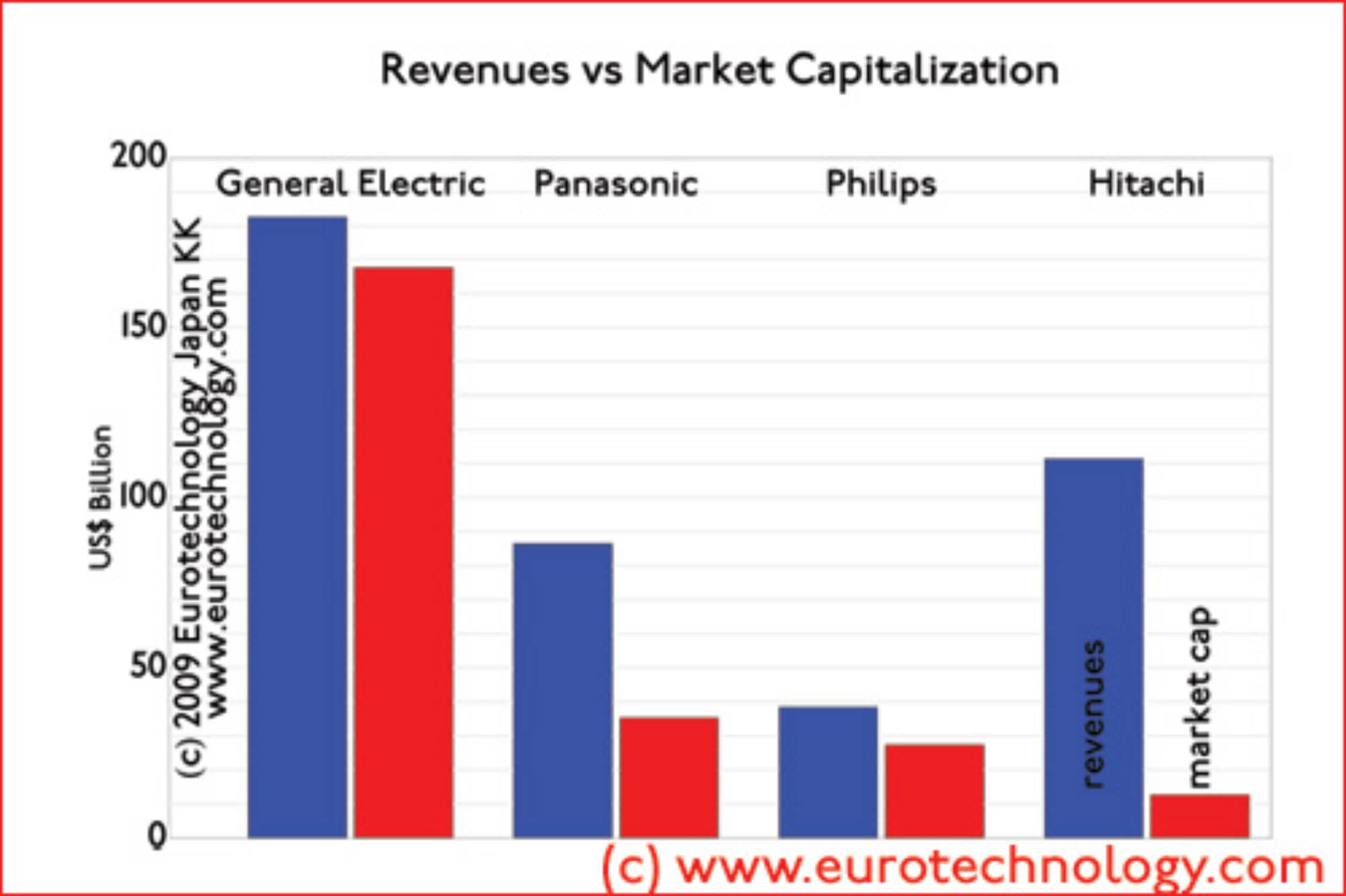

Japan’s Galapagos effect on market caps

Japan’s electronics giants market caps are remarkably low General Electric’s market cap is about 13 times higher that of Hitachi Some of Japan’s electrical corporations have remarkably low market capitalizations: General Electric has 1.6 x more sales than Hitachi, but has 13.3 x the market capitalization. Philips has 1/3 x Hitachi’s sales, but has 2.2…

-

Post-Galapagos Japan? – globalizing Japan’s fantastic technologies…

Japan Galapagos effect: “Why do Japanese companies make so beautiful mobile phones with fantastic functions, and have almost no global market share?” I asked this question back in 2003 to NTT-DoCoMo’s CEO Dr. Tachikawa (see my article “Leadership questions of the week” in Wallstreet Journal of June 12, 2006, page 31), and offered several proposals…

-

Mobile internet coming of age: i-Mode’s 18th birthday

The global mobile internet was born today 18 years ago, on February 22, 1999 by Gerhard Fasol NTT Docomo announced the start of i-Mode on February 22, 1999 at a press conference in Tokyo Today, 18 years ago, on February 22, 1999, Mari Matsunaga, Takeshi Natsuno, and Keiichi Enoki announced the start of the world’s…

-

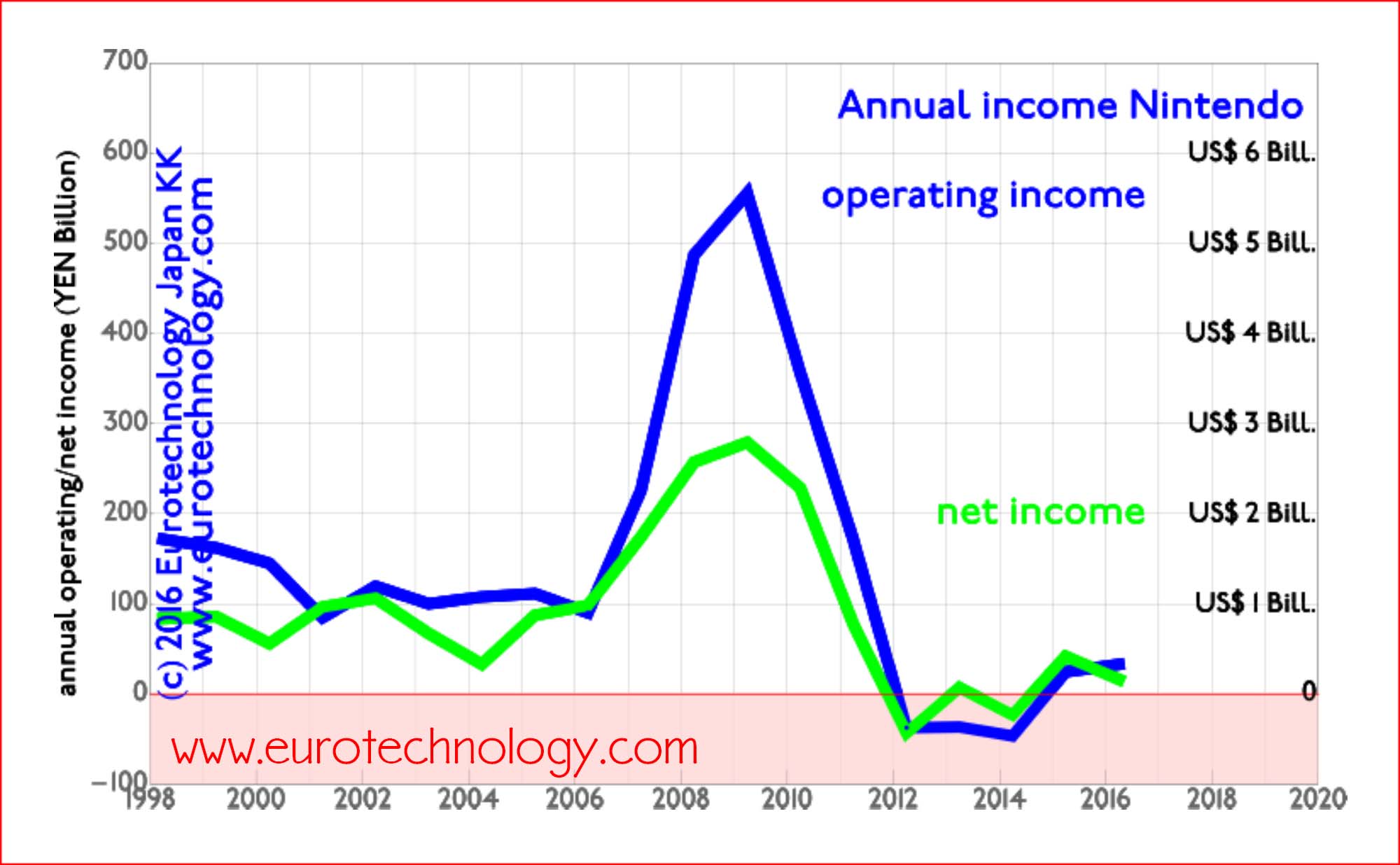

Pokemon Go – everybody loves Pikachu…

Pokemon Go is great – but will it bring another Nintendo boom as in 2009? or even exceed 2009? Google spin-out Niantic Labs’ augmented reality smartphone game booms to the top of charts Niantic Labs is specialized on augmented reality games. In a previous game, Ingress, players selected about 15 million memorable locations globally. Niantic…

-

Sir Stephen Gomersall: Globalization and the art of tea

by Hitachi Chief Executive for Europe and subsequently Hitachi Board Director (2004-2014) Sir Stephen Gomersall: Princess Chichibu Memorial Lecture to the Japan British Society at Ueno Gakuen, Tokyo, 5 March 2015 Sir Stephen Gomersall: It is a great honour to be giving this lecture this evening. HIH Princess Chichibu was a charming and broad-minded Patron…

-

Japanese acquisitions in Europe total € 6 billion in 2015

Overcoming Japan’s “Galapagos syndrome” Globalizing Japan’s high-tech industries At the Bank of Kyoto’s New Year celebration meeting, Japan’s stagnation and need for globalization were center of discussion – despite focus on globalization, the present author was more or less the only non-Japanese invited and attending(!). The Chairman of Japan’s Industry Federation KEIDANREN, Mr Sakakibara (Chairman…

-

i-Mode was launched February 22, 1999 in Tokyo – birth of mobile internet

The mobile internet was born 16 years ago in Japan Galapagos-Syndrome: NTT Docomo failed to capture global value On February 22, 1999, the mobile internet was born when Mari Matsunaga, Takeshi Natsuno and Keiichi Enoki launched Docomo’s i-Mode to a handful of people who had made the effort to the Press Conference introducing Docomo’s new…

-

Japan in 2015 – analysis

Thoughts and analysis for 2015 Abenomics?! The trick of course is the third arrow, the reforms. Read what Professor Takeo Hoshi has to say about Abenomics, Japanese economist, who has worked his way up US Universities, and has now reached the position of Professor of Economics at Stanford University. By the way, here is my…

-

Apple Pay vs Japan’s Osaifu-keitai – the precursor to Apple Pay

What can we learn from 10+ years of mobile payments in Japan? Apple Pay vs Japan’s Osaifu-Keitai: watch the interview on CNBC https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html?play=1 Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) Japan’s Osaifu keitai mobile payments started on July 10, 2004, after public testing during December 2003 – June 2004 Two different…

-

Nokia No. 1 in Japan! – Panasonic to sell mobile phone base station division to Nokia

Nokia strengthens No. 1 market position in Japan’s mobile phone base station market! Japan’s mobile phone base station market Japan’s mobile phone base station market is about US$ 2.6 billion/year and for European companies Ericsson and Nokia the most important market globally, although certainly also the most difficult one. Nokia is No. 1 with a…

-

Steve Jobs and SONY: why do Steven Jobs and SONY reach opposite answers to the same question: what to do with history?

Steve Jobs and SONY: why 180 degrees opposite decisions? Steve Jobs donates history to Stanford University in order to focus on the future Steve Jobs and SONY – when Steve Jobs when returned to Apple in 1996, and now SONY are faced with the same question: what to do about corporate archives and the corporate…

-

Japanese management – why is it not global? asks Masamoto Yashiro at a Tokyo University brain storming event

Japanese management – why is it not global? What should we do? Keynote speech by Masamoto Yashiro at brainstorming by President of Tokyo University summary of Masamoto Yashiro’s talk written by Gerhard Fasol Masamoto Yashiro is a legend in Japan’s banking and energy industry. He built Shinsei Bank from the ashes of the bankrupt Long…

-

Docomo postpones Tizen OS mobile handsets for the second time

Below are notes for an interview for the French newspaper LesEchos. The full article can be found here. On Thursday January 16th, 2014, NTT Docomo announced the postponement of mobile phone handsets based on the TIZEN operating system. This is actually the second time that NTT Docomo has postponed the planned introduction of TIZEN handsets,…

-

Japan Perspectives for 2014: can Abenomics succeed? Can Japan grow again? Can Japan solve the population crisis?

Will Abenomics succeed? Stanford Economics Professor Takeo Hoshi thinks that there is a 10% chance that Abenomics will succeed to put Japan on a 2%-3% economic growth path, while the most likely outcome will be 1% economic growth. Read our notes of Professor Hoshi’s talk in detail here. Can Japanese companies globalize? “Globalization” of course…

-

Supercell wins SoftBank and GungHo investment

Supercell investment by SoftBank and GungHo Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets. SoftBank…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…

-

Hiroshi Mikitani about the Japan Association of New Economy (JANE)

Hiroshi Mikitani about how Japan should become more competitive Hiroshi Mikitani: presentation of his new book = Competitiveness Today Hiroshi Mikitani, Founder and Chairman of Rakuten, gave a talk at the Foreign Correspondents Club about his Japan Association of New Economy (JANE) and about his new book authored with his father entitled Competitiveness. Mikitani is…

-

Japan telecommunications, internet and cloud markets

—

by

Japan invented the mobile internet, and Japan’s telecommunications markets are among the world’s largest, most profitable, most advanced and also most liberalized Japan mobile communications Japan’s mobile communications originally started as a division of Japan’s telecom monopoly NTT, which developed into today’s NTT-Docomo. After several steps of liberalization, a considerable number of telecommunications venture companies…

-

NEC smartphone termination, discussions with Lenovo failed

NEC smartphone – admits losing against competition from Apple and Samsung NEC smartphone – NEC used to be No. 1 in Japan’s “Galapagos keitai” market Just a few years ago, NEC was No. 1 in market share of Japanese pre-smart phone “Galake” (Galapagos-keitai, for a review of Japan’s Galapagos effect click here) super-feature phones. Recently…

-

Japan market intelligence, technology market analysis

—

by

Japan market insights – since 1997 we work in Japan’s technology markets, build businesses Japan market intelligence: Research, due diligence, analysis, technology licensing and business development Japan market intelligence For industrial clients We work since 1997 in Japan’s technology markets focusing on telecommunications and energy, we have worked with 100s of companies on market entry…

-

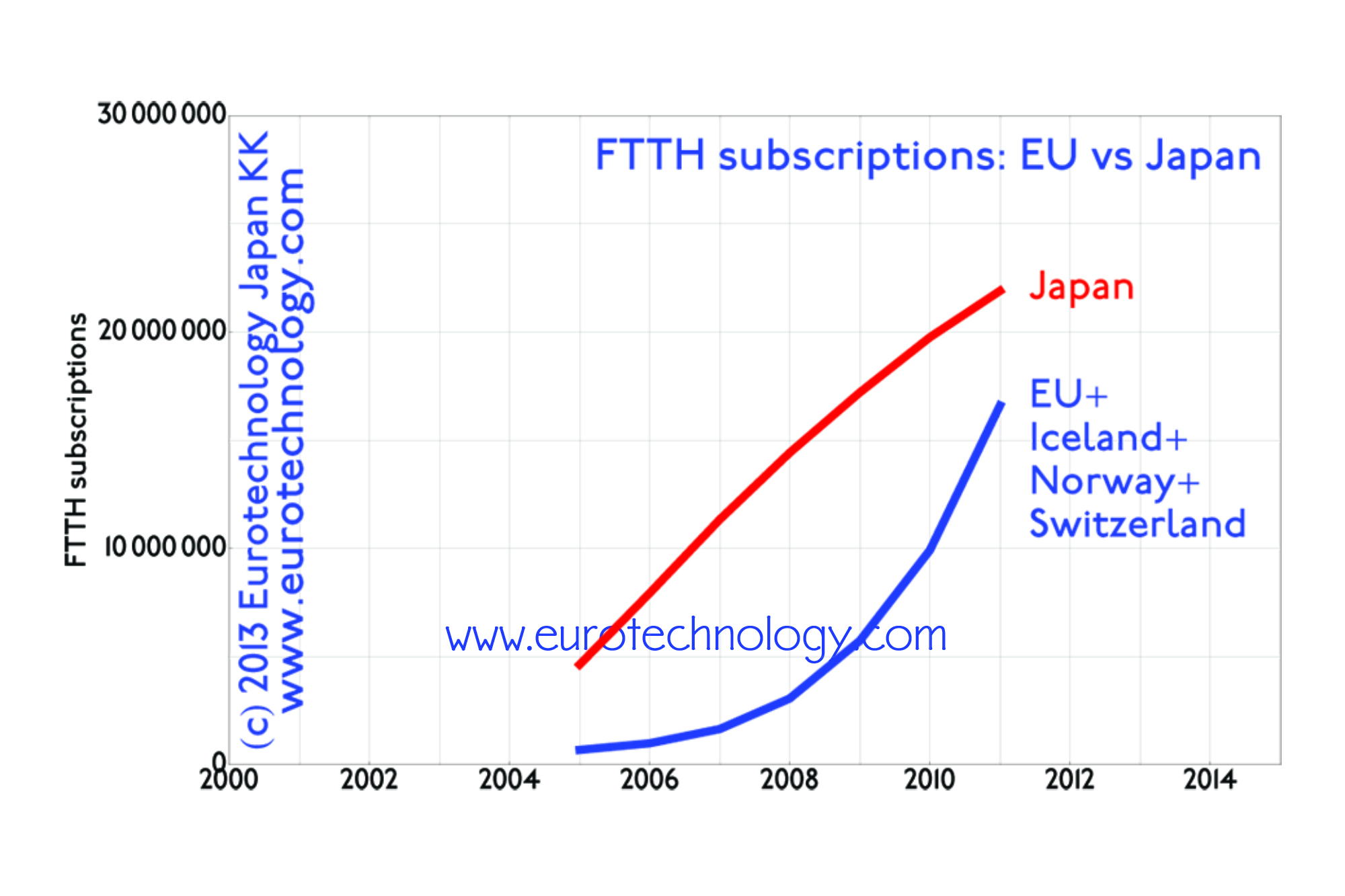

FTTH Japan Europe: more FTTH broadband subscriptions in Japan than in all of EU + Norway + Switzerland + Iceland

by Gerhard Fasol Japan has more broadband fixed internet subscriptions than all of the European Union + Switzerland + Norway + Iceland FTTH Japan Europe: While Japan initially was late in waking up to the commercial introduction of the Internet – Japan was fast to catch up and overtake Japan alone currently has about 30%…

-

Japan telecommunications industry (66th edition) – Market analysis & tutorial

—

by

Market research report – A practical tutorial on Japan’s telecom markets. Japans telecommunications industry: current status, M&A transaction and consolidation history. Understand the key players. pdf-file, 66th edition, of July 6, 2015 approx. 272 pages, 90 Figures, 49 Photographs, 30 tables, 4 Mbyte Lead author: Gerhard Fasol, works since 1984 with Japan’s telecommunications industry. Japan…

-

Japan electronics industries: mono zukuri

—

by

Japan’s electronics component makers thrive, while Japan’s top-8 electronics groups stagnate Financial and business data and analysis of Japan’s top 8 electronics groups and major electronics parts makers Report, pdf-file, Version 26 of July 21, 2015 approx. 237 pages, 100 Figures, 20 Photos, 29 tables, 2.3 Mbyte Lead author: Gerhard Fasol, works since 1984 with…

-

Events, conferences and speaking engagements

—

by

Ludwig Boltzmann Forum: driving improvements by bringing logic and science to leadership information on our Ludwig Boltzmann Forum events Presentations and events: Japan’s energy – myths versus reality Gerhard Fasol, Wednesday, June 19th, 2013, 18:30, Embassy of Sweden, Alfred Nobel Auditorium, Tokyo, Stockholm School of Economics, European Institute of Japanese Studies for details: “Japan’s energy…

-

Taiwan’s Hon Hai Group invests in SHARP

Crunch time? – reviving Japan’s huge electrical/electronics sector SHARP fighting for survival SHARP (6753) last month forecast a record YEN 290 Billion (US$ 3.5 Billion) loss for this financial year – more than 1/2 of SHARP’s market cap, and SHARP’s new Sakai factory is reported to work at 1/2 capacity. Taiwan’s Hon Hai Group (which…

-

Rebuilding Tohoku’s disaster areas: 1st session of 15-member Rebuilding Council

Rebuilding Tohoku After the Kobe/Hanshin earth quake rebuilding took about 18 months Rebuilding Tohoku: After the Kobe/Hanshin earth quake rebuilding took about 18 months – maybe this is a good measure to estimate how long rebuilding will take in Tohoku. In Tohoku communities will certainly be rebuilt in locations which are much better protected against…