Tag: softbank

-

Mobile internet coming of age: i-Mode’s 18th birthday

The global mobile internet was born today 18 years ago, on February 22, 1999 by Gerhard Fasol NTT Docomo announced the start of i-Mode on February 22, 1999 at a press conference in Tokyo Today, 18 years ago, on February 22, 1999, Mari Matsunaga, Takeshi Natsuno, and Keiichi Enoki announced the start of the world’s…

-

SoftBank acquires ARM Holdings plc: paradigm shift to internet of things (IoT) and a Vodafone angle

On 18 July 2016 SoftBank announced to acquire ARM Holdings plc for £17 per share, corresponding to £24.0 billion (US$ 31.4 billion) SoftBank acquires ARM: acquisition completed on 5 September 2016, following 10 years of “unreciprocated love” for ARM On 18 July 2016 SoftBank announced a “Strategic Agreement”, that SoftBank plans to acquire ARM Holdings…

-

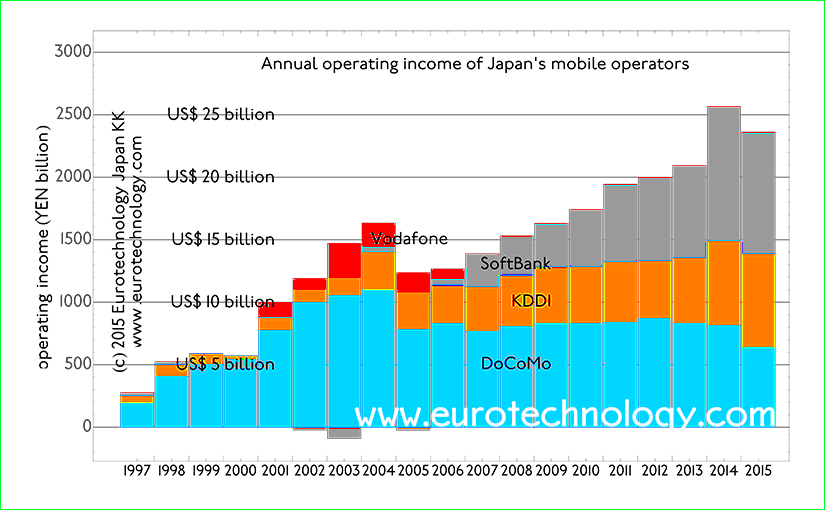

Japan mobile operators grow to US$ 25 billion in operating profits for FY2014 (ended March 31, 2015)

Annual revenues exceed US$ 170 billion in FY2014 Japan’s mobile telecommunications sector continues to grow The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile…

-

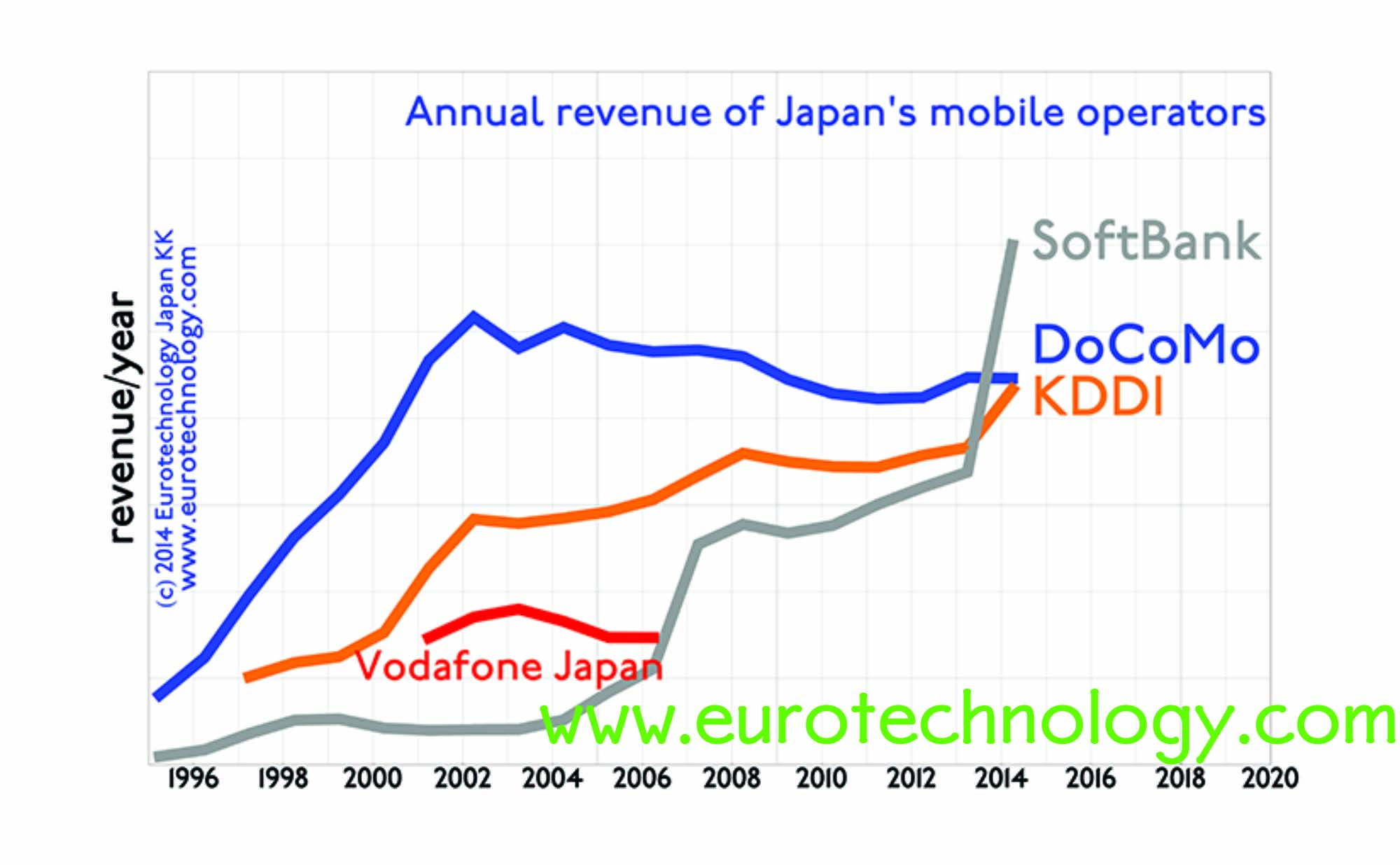

SoftBank overtakes Docomo and KDDI in revenues and income and market cap

SoftBank overtakes Docomo and KDDI in all major KPIs SoftBank presents annual results for the Financial Year which ended March 31, 2014 today, NTT-Docomo and KDDI presented their results a few days ago. Using projections published by SoftBank and using data found in the Japanese business press over the recent days, we have compared SoftBank,…

-

Docomo financial report for FY2013: operating income of YEN 819 billion (US$ 8.2 billion)

Docomo financial report for FY2013: US$8.2 billion operating profits but withdraws from India by Gerhard Fasol On April 25, 2014 NTT-Docomo announced annual results for FY2013 (April 1, 2013 – March 31, 2014) and explained the way forward. Annual revenues are YEN 4461.2 billion (US$ 33.6 billion), operating income is YEN 819.2 billion (US$ 8.19…

-

Japan energy mix: Keeping the lights on in Japan – deregulation, new and renewable energy

Japan energy mix, smart grid, electricity deregulation – briefing by The Economist Corporate Network Economist Corporate Network held a breakfast briefing today April 24, 2014 for about 50 Japan-CEOs and executives. Shigeki (Sean) Miwa, General Manager of SoftBank’s CEO Office, and Representative Director & CEO of Bloom Energy Japan KK, and EVP of SB Energy…

-

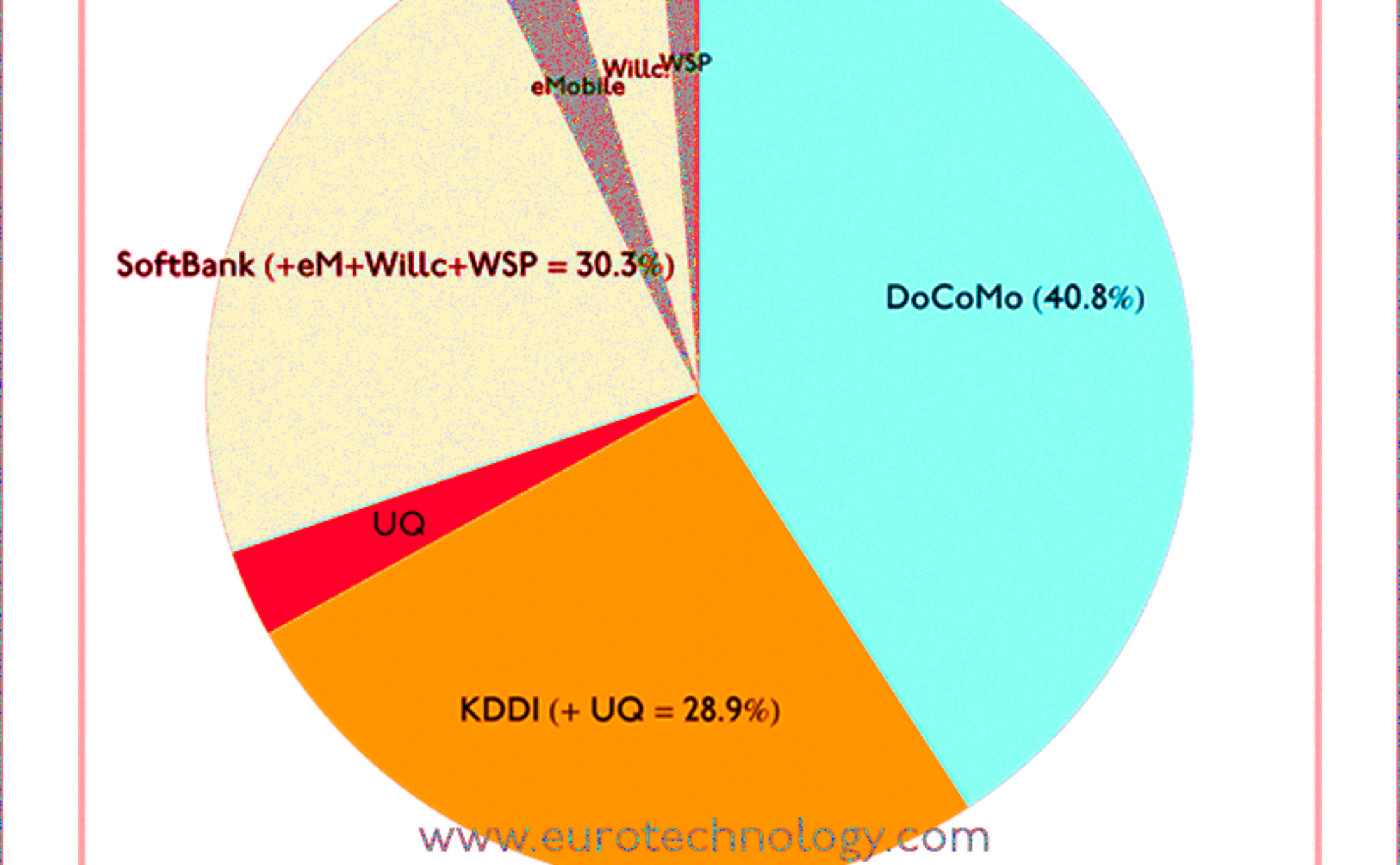

SoftBank market share in Japan – many articles get it wrong. What is SoftBank’s true market share in Japan?

by Gerhard Fasol Many press articles get SoftBank market share in Japan wrong With SoftBank‘s acquisition of US No. 3 mobile operators Sprint and the possibility that Softbank/Sprint will also acquire No. 4 T-Mobile-USA, SoftBank and Masayoshi Son are catching global headlines. SoftBank market share in Japan: Many media articles report wrong data, because they…

-

Japan Perspectives for 2014: can Abenomics succeed? Can Japan grow again? Can Japan solve the population crisis?

Will Abenomics succeed? Stanford Economics Professor Takeo Hoshi thinks that there is a 10% chance that Abenomics will succeed to put Japan on a 2%-3% economic growth path, while the most likely outcome will be 1% economic growth. Read our notes of Professor Hoshi’s talk in detail here. Can Japanese companies globalize? “Globalization” of course…

-

“Japanese superman Masayoshi Son” invests in Supercell (interview for Talouselämä, Finland’s largest business newspaper)

“Japanese superman Masayoshi Son” invests in SuperCell – interview with Finland’s largest business newspaper Talouselämä Talouselämä (Finland’s largest business newspaper)’s news editor Mirva Heiskanen interviewed me for their article entitled “Japanese superman Masayoshi Son invests in Supercell” (Supercellin ostaja Masayoshi Son on Japanin supermies). More interviews by Gerhard Fasol. To understand SoftBank better, read our…

-

Supercell wins SoftBank and GungHo investment

Supercell investment by SoftBank and GungHo Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets. SoftBank…

-

Rakuten vs SoftBank + Yahoo vs Amazon (Bloomberg and BusinessWeek interviews)

Rakuten vs Softbank Yahoo reduces e-commerce fees to compete harder with Rakuten’s online mall Bloomberg interview and BusinessWeek interview about Yahoo KK’s aggressive reduction of ecommerce fees, a move increasing competition with Amazon.com and Rakuten. How do you see Yahoo KK’s latest move to reduce or eliminate merchant’s fees? Do you see this as an…

-

Masayoshi Son threatened to set himself on fire in Japan’s Postal Ministry?!

Masayoshi Son threatened to set himself on fire in Japan’s Post and Telecommunications Ministry? Is it really true? by Gerhard Fasol Masayoshi Son is known for his unbreakable will to achieve his and his companies’ business goals, and the will to take risks. Masayoshi Son threatened to set himself on fire in the Ministry?!? Spectrum…

-

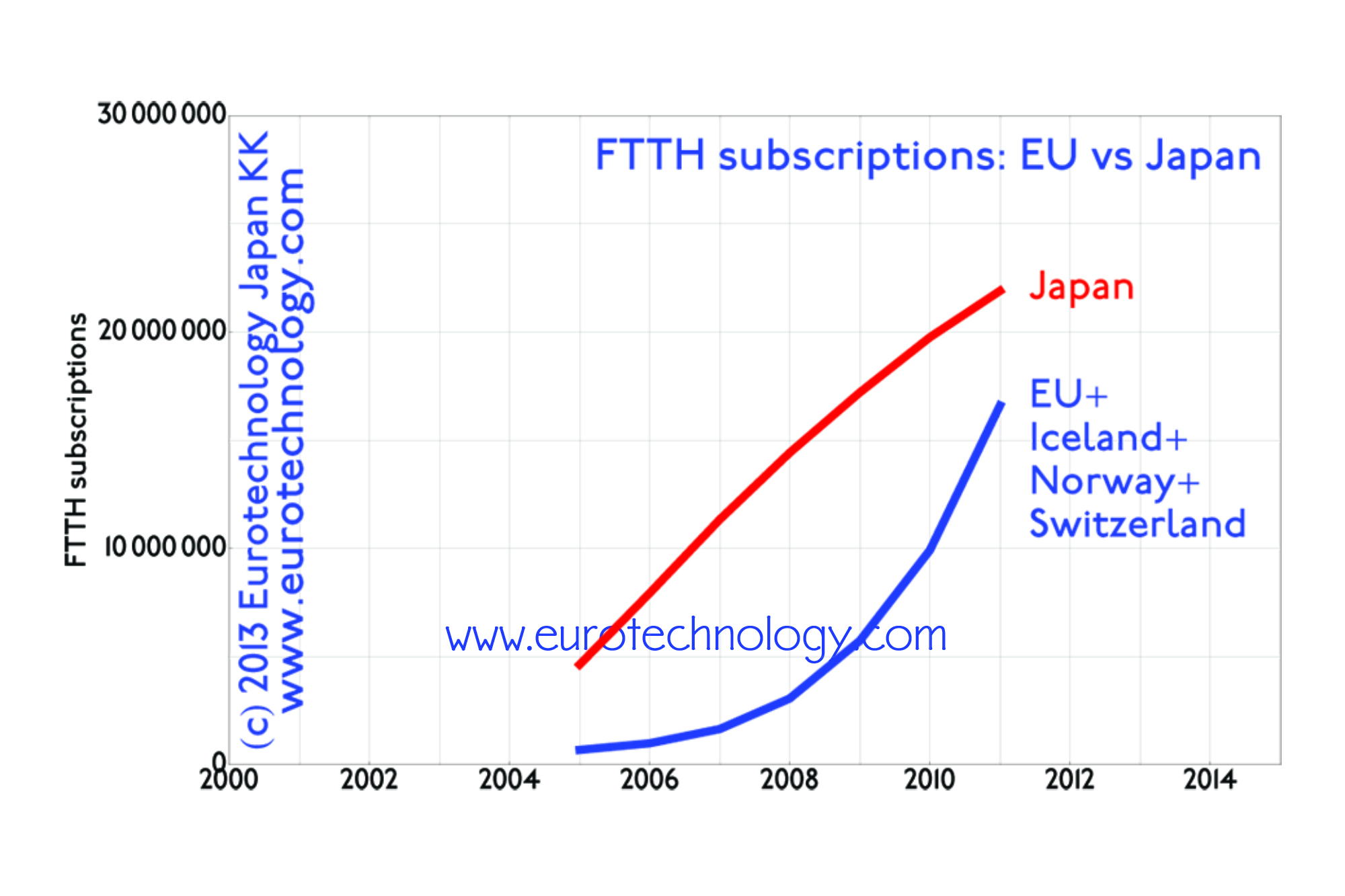

FTTH Japan Europe: more FTTH broadband subscriptions in Japan than in all of EU + Norway + Switzerland + Iceland

by Gerhard Fasol Japan has more broadband fixed internet subscriptions than all of the European Union + Switzerland + Norway + Iceland FTTH Japan Europe: While Japan initially was late in waking up to the commercial introduction of the Internet – Japan was fast to catch up and overtake Japan alone currently has about 30%…

-

Growth in Japan: the SoftBank group

SoftBank gaining market share in Japan SoftBank market cap catching up with Docomo Mobile subscription data released last week show, that the SoftBank group continues to gain market share while incumbent NTT-docomo continues to lose market share – an upward trend for SoftBank, and a downward trend for NTT-docomo essentially unbroken since SoftBank acquired Vodafone-Japan…

-

Masayoshi Son: “I am a man – and I want to be Number 1”

SoftBank aims for global No. 1 position…acquiring SPRINT on the way to the top SoftBank: towards global No. 1 with a 300 year vision To understand SoftBank, and the planned SPRINT acquisition, you need to understand Masayoshi Son – and Masayoshi Son says: “I am a man – and I want to be Number 1”.…

-

Japan telecom sector financial results and the Softbank-Sprint take-over battle

SoftBank seeks to win, where Docomo failed – taking Japan’s telecoms know-how global Japan telecom sector financial results: very very healthy With SoftBank and DISH battling for US mobile operator SPRINT, the eyes are on Japan’s very healthy mobile phone sector, which a few days ago announced financial results for FY 2012. Japan’s mobile operators…

-

Japan wireless industry boom driven by smartphones. Japan adds about two Finlands worth of wireless subscriptions per year.

Japan wireless industry adds 11 million subscriptions/year currently Softbank targets ¥ 1 Trillion operational income Japan wireless industry is growing, and Japan’s mobile operators add 11 million subscriptions/year currently: Japan adds about two Finlands worth of wireless subscriptions per year. Softbank entered the telecom arena in 2001 with Yahoo BB, Nagoya Metallic and later Osaka…

-

Japan trends for 2013 (New Year post)

Japan replaced nuclear electricity generation by LNG, by imported gas Japan trends for 2013: Nuclear reactor restarts are on their way Japan trends for 2013 Japan’s energy sector: Japan has essentially replaced the 30% of its electricity energy supply which was from nuclear power plants, by electricity produced in aging thermal power plants from urgently…

-

When did qr-codes start on mobile phones? (in August 2002)

qr-codes were developed by Toyota subsidiary denso-wave When did qr-codes start on mobile phones: First mobile phone with qr-code reader was the J-SH09 by SHARP for Japanese mobile operator J-Phone When did qr-codes for mobile phones start in Japan? Here is the answer: the first mobile phone with qr-code reader was the J-SH09 produced by…

-

Potential Flu Pandemic Positive for Telcos

Potential Flu Pandemic Positive for Telcos (Airtime: Tuesday, April 28, 2009) Read more about Japan’s telecom sector: http://www.eurotechnology.com/store/jcomm/ Read more about DoCoMo: http://www.eurotechnology.com/store/imode/ Read more about KDDI: http://www.eurotechnology.com/store/kddi/ Read more about Softbank: http://www.eurotechnology.com/store/softbank/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Wild differences in operating margins for mobile, TV media groups and electricals

We analyze the effect of the crisis on operating margins in three different sectors in Japan: (1) electronics, (2) mobile communications (3) TV media groups. In sector (1), Nintendo‘s margins are above 30% and increasing despite the crisis, while traditional electronics companies’ margins are evaporating. (2) for mobile operators DoCoMo, KDDI and SoftBank margins are…

-

eMobile – interview with CEO and founder Dr Sachio Semmoto by Dr. Gerhard Fasol

New entrant challenging Japan’s mobile incumbents Docomo and KDDI and SoftBank. A discussion between Dr Sachio Semmoto and Dr. Gerhard Fasol Dr Sachio Semmoto: one of Japan’s most successful serial entrepreneurs eMobile is Japan’s newest & fastest growing mobile operator, focused on mobile broadband – currently at HSDPA speeds up to 7.2 Mbps and HSUPA/EUL…

-

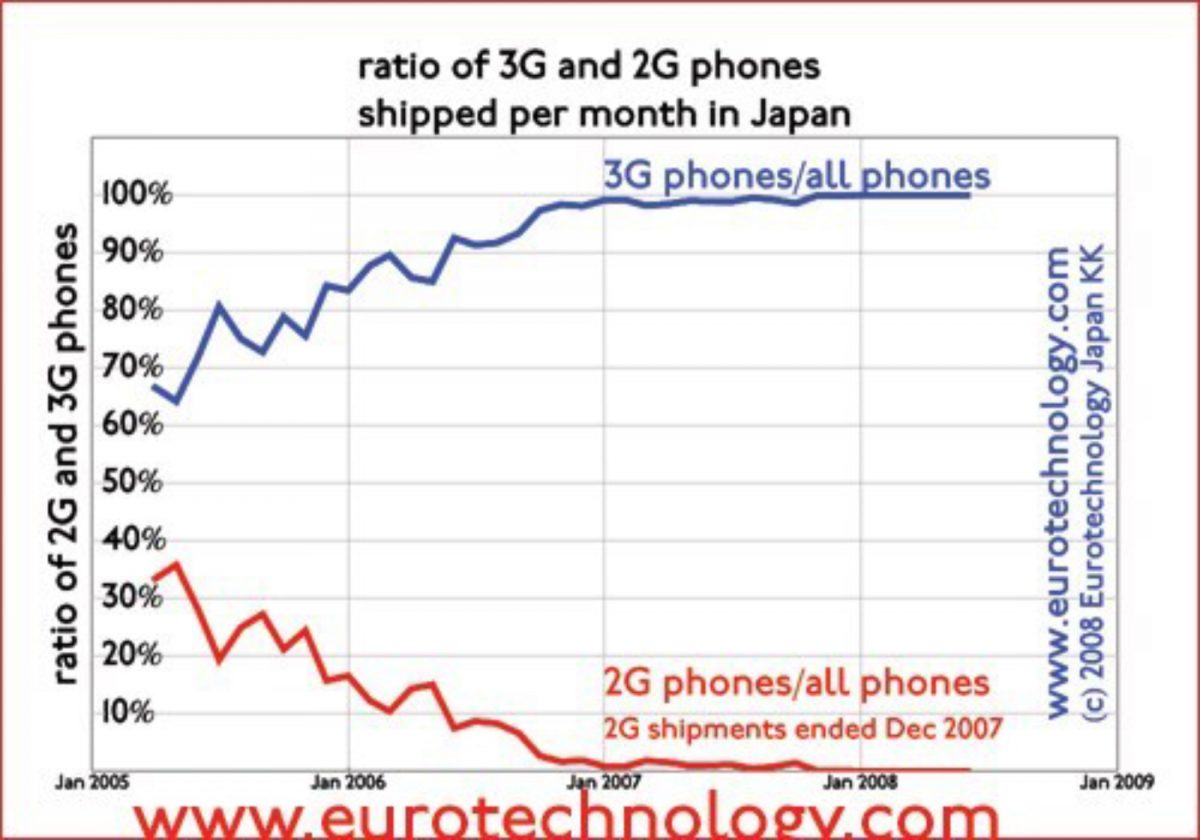

Last 2G phone shipped 8 months ago in Japan, 2G networks are switched off

KDDI/AU switched off 2G radio network in March 2008, Docomo and SoftBank to switch off 2G networks in 2009 Second generation (2G) phones silently bowed out of Japan’s market 8 months ago: the last 2G phones in Japan were shipped in December 2007. KDDI/AU switched off their 2G radio network in March 2008, this year,…

-

Will the iPhone trigger a turning point in Japan’s mobile phone industry?

Tetsuzo Matsumoto (Senior Executive Vice-President and Board Member of SOFTBANK MOBILE Corporation), Gerhard Fasol (CEO, Eurotechnology Japan KK)and Dennis Normile (Japan Correspondent of SCIENCE Magazine, and FCCJ) discuss about the future of Japan’s mobile phone market. “Will the iPhone trigger a turning point in Japan’s mobile phone industry?”(Foreign Correspondents’ Club of Japan, Tokyo Wednesday, August…

-

How many iPhones were sold in July 2008 in Japan?

How many iPhones did SoftBank sell in Japan during July? Our estimate: between 75,000 – 125,000. Read on about how we arrived at this estimate. Net growth of mobile subscription numbers in Japan (Japan’s mobile market grows by about 5.5 million per year – for more analysis read our JCOMM-Report). How did we arrive at…

-

Japan’s Mobile Space Not Saturated

More in our J-COMM report: http://www.eurotechnology.com/store/jcomm/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Yahoo Japan – Yahoo! Complication

There are two YAHOO!s – YAHOO! Inc and YAHOO! KK. (ヤフー株式会社) Yahoo! KK, ヤフー株式会社 is a Japanese corporation listed on the Tokyo Stock Exchange Yahoo! KK (ヤフー株式会社) is not a full/100% subsidiary of Yahoo Inc, but Yahoo! KK is a publicly traded company, listed on the Tokyo Stock Exchange. Ownership of Yahoo! KK (ヤフー株式会社) 35.45%…

-

Mobile Industry Resilient to the downturn (CNBC TV interview)

More in our report on Japan’s telecom and mobile sector Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

iPhone Dials into Japan (CNBC TV interview)

More about SoftBank and SoftBank’s iPhone business in Japan Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Market caps of companies in mobile: global vs local

Google, Apple, Nokia, HTC, Vodafone and are winning the driver’s seat of the global internet revolution. DoCoMo, KDDI and SoftBank essentially stay inside Japan for now – limiting their growth prospects and leaving global opportunities to others. GOOGLE with Android and APPLE with iPhone are reaching for the driver’s seat of the global mobile data…