Tag: accounting

-

Quarterly financial reports to go away: UK and EU remove requirements for quarterly financial reports

Voluntary quarterly reporting? Quarterly financial reports: can they be the trees which obscure long term growth of the forrest? As a Board Director of a Japanese company traded on the Tokyo Stock Exchange I have to study and approve monthly, quarterly and annual financial reports, and I share responsibility for the future success of the…

-

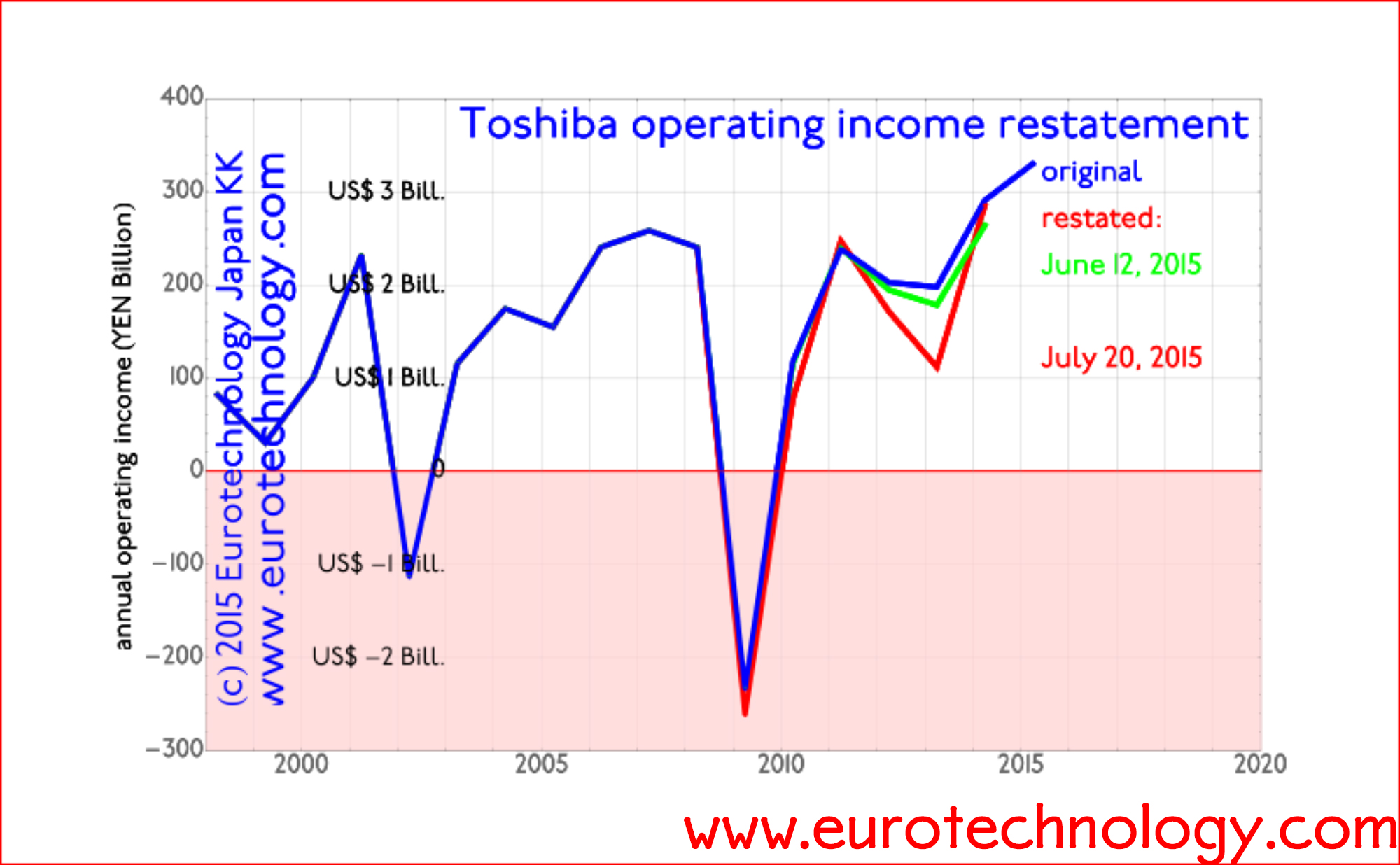

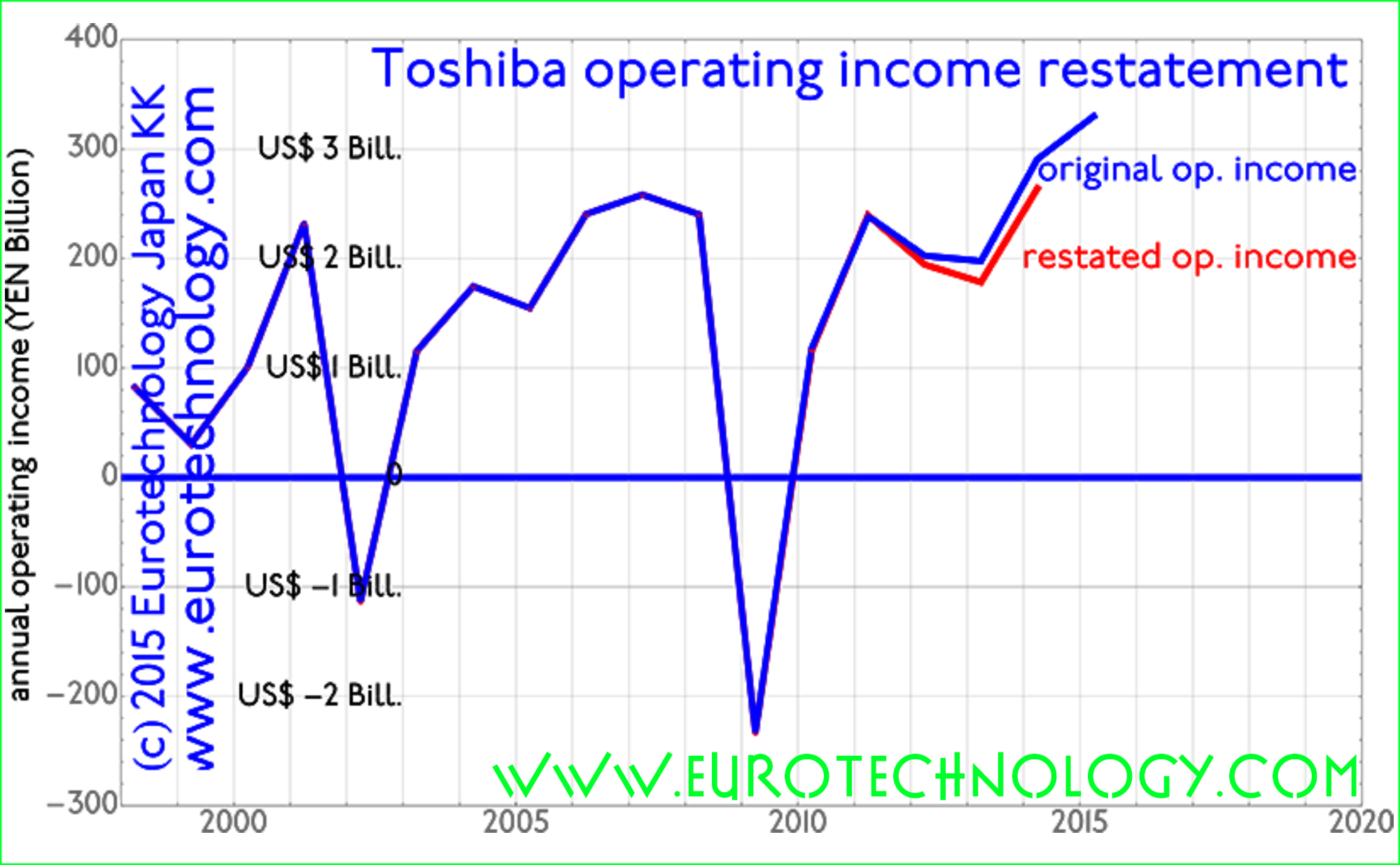

Toshiba income restatement: corresponds to one full year of average operating income

Toshiba’s income restatement announced by the independent 3rd party committee by Gerhard Fasol Independent 3rd party committee chaired by former Chief Prosecutor of Tokyo High Court On 12 June, 2015, Toshiba announced corrections to income reports, and at the same time engaged an independent 3rd party investigation committee headed by former Chief Prosecutor at the…

-

Toshiba accounting restatements in context

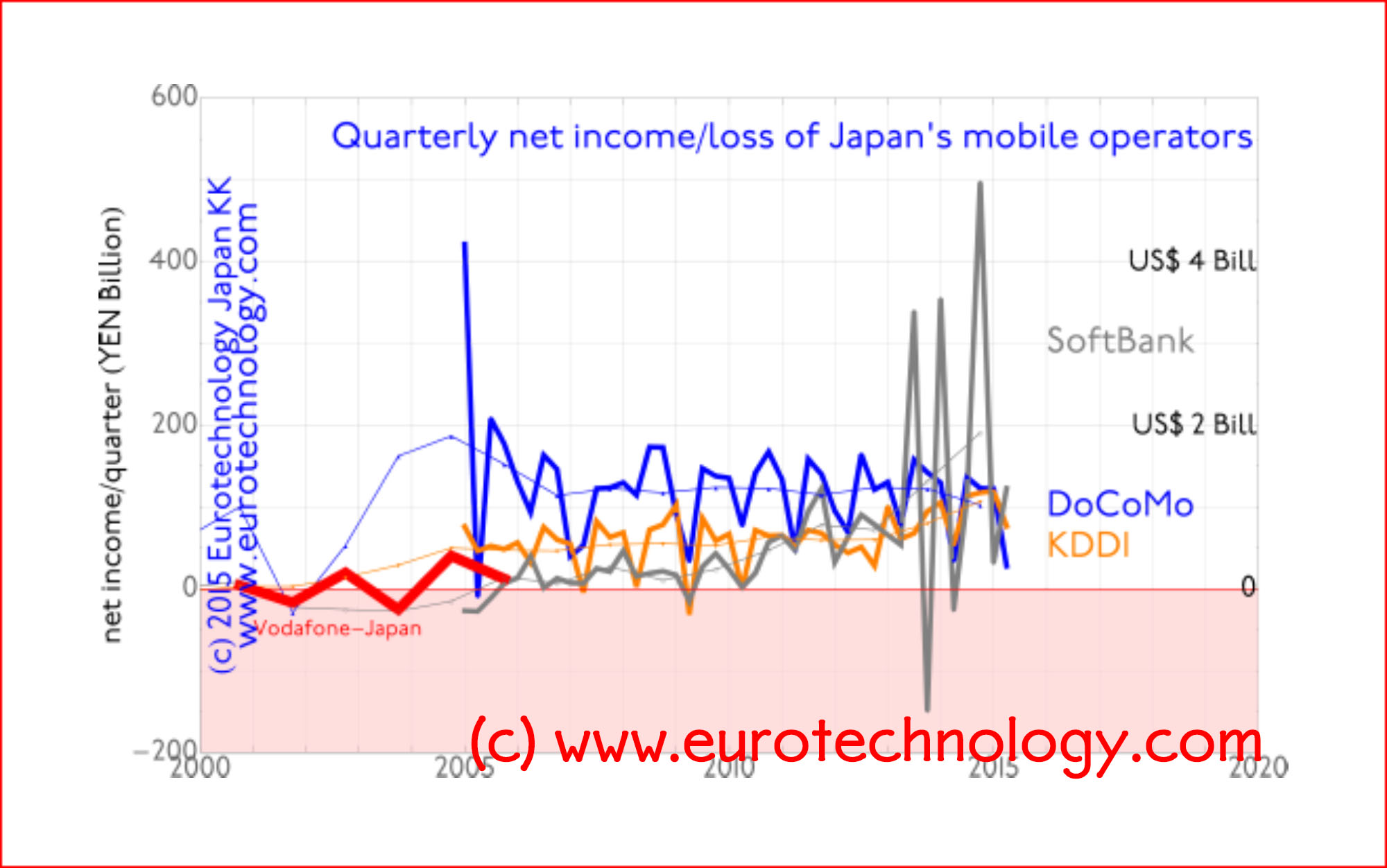

July 21, 2015: Update – report of the independent 3rd party committee chaired by former Chief Prosecutor of the Tokyo High Court. Corrections amount to 2 1/2 years (31.5 months) of average annual net profits by Gerhard Fasol Sales stagnation combined with almost zero net profit of Japan’s top 8 electronics companies creates increasing pressure…