Category: M&A

-

Toshiba nuclear write-off. BBC interview about Toshiba’s latest nuclear industry write-offs

Toshiba is expected to announce write-off provisions on the order of US$ 6 billion today Toshiba is on Tokyo Stock Exchange warning list for possible delisting in March 2017 by Gerhard Fasol This morning 7:30am I was interviewed on BBC TV Asia Business Report about an update of Toshiba’s ongoing crisis, which has been 20…

-

SoftBank acquires ARM Holdings plc: paradigm shift to internet of things (IoT) and a Vodafone angle

On 18 July 2016 SoftBank announced to acquire ARM Holdings plc for £17 per share, corresponding to £24.0 billion (US$ 31.4 billion) SoftBank acquires ARM: acquisition completed on 5 September 2016, following 10 years of “unreciprocated love” for ARM On 18 July 2016 SoftBank announced a “Strategic Agreement”, that SoftBank plans to acquire ARM Holdings…

-

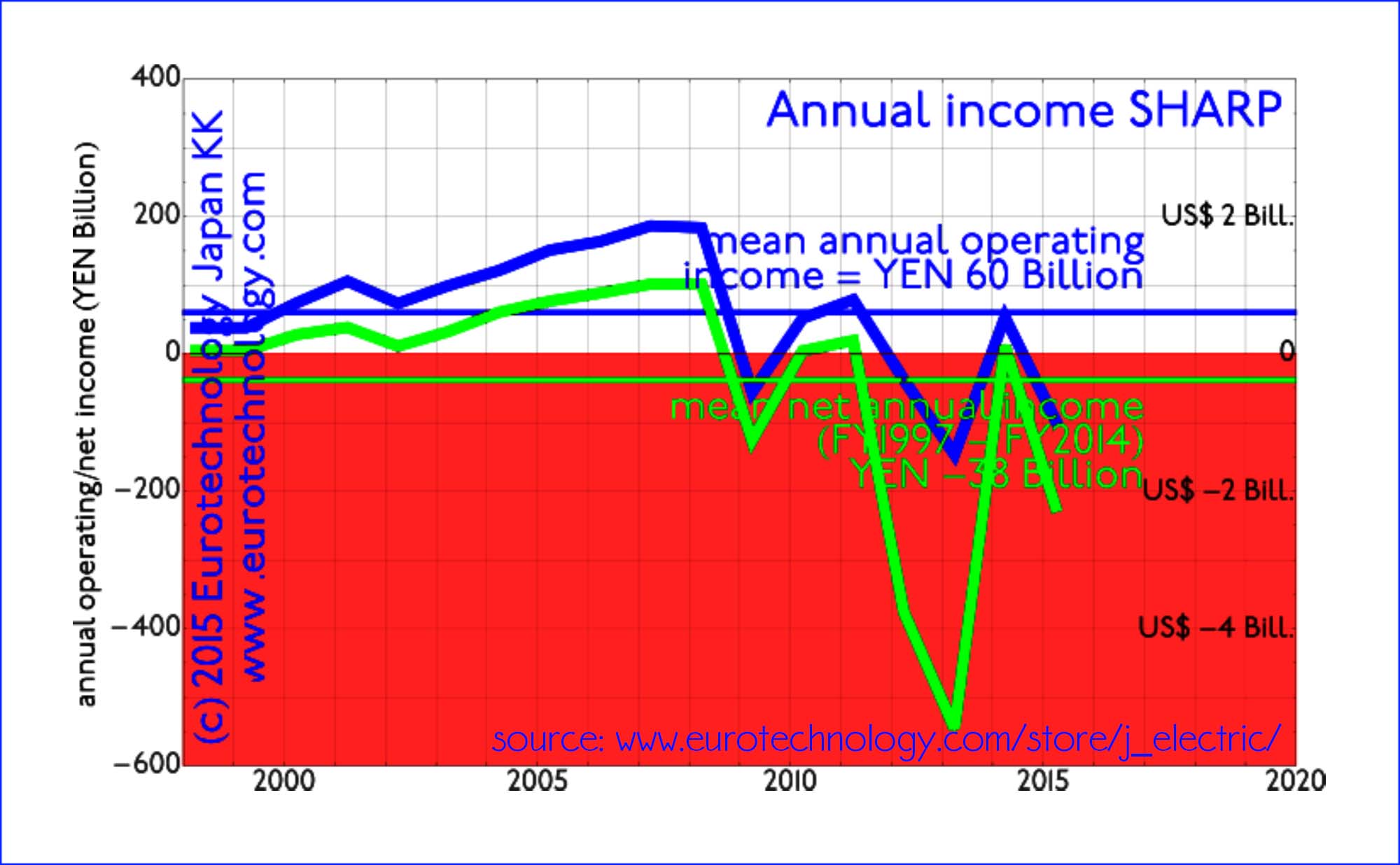

SHARP and the future of Japan’s electronics

SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector The need for focus and active portfolio management SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March. Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete…

-

Economic growth for Japan? A New Year 2016 preview

Economic growth for Japan in 2016? Economic growth: Almost everyone agrees that economic growth is preferred over stagnation and decline. Fiscal policy and printing money unfortunately can’t deliver growth. Building fresh new successful companies, returning stagnating or failed established companies back to growth (see: “Speed is like fresh food” by JVC-Kenwood Chairman Kawahara), and adjusting…

-

Was Osamu Suzuki first to understand Volkswagen’s Diesel issues?

Osamu Suzuki: “we looked at Wagen’s technologies, and could not find anything we need” (Nikkei, 1 July 2011) by Gerhard Fasol Did Volkswagen underestimate Mr Suzuki? Over the last 18 years myself and our company have worked on many foreign-Japanese company partnerships, therefore we always have great interest in business partnerships involving Japanese companies, and…

-

Mr. Suzuki didn’t want to be a Volkswagen employee, and that’s understandable (Prof. Dudenhoeffer via Bloomberg)

Mr Suzuki (Chairman of Suzuki Motors), wrote in his Japanese blog, that “ending the partnership with Volkswagen (Wagen-san as he calls VW) was like the relieve I feel after having a fishbone stuck in my throat removed” No partnership works without meeting of minds, with opposite agendas and colliding expectations by Gerhard Fasol, All Rights…

-

Burberry Japan: breaking up is hard to do

Burberry Japan pivots from successful partnership to direct business by Gerhard Fasol, All Rights Reserved. Sanyo Shokai pivots from Burberry to Mackintosh and other brands Burberry Japan pivots to direct business to solve Burberry’s “Japan Problem”: for the last approx. 50 years Burberry’s business in Japan was not Burberry’s business at all, but run under…

-

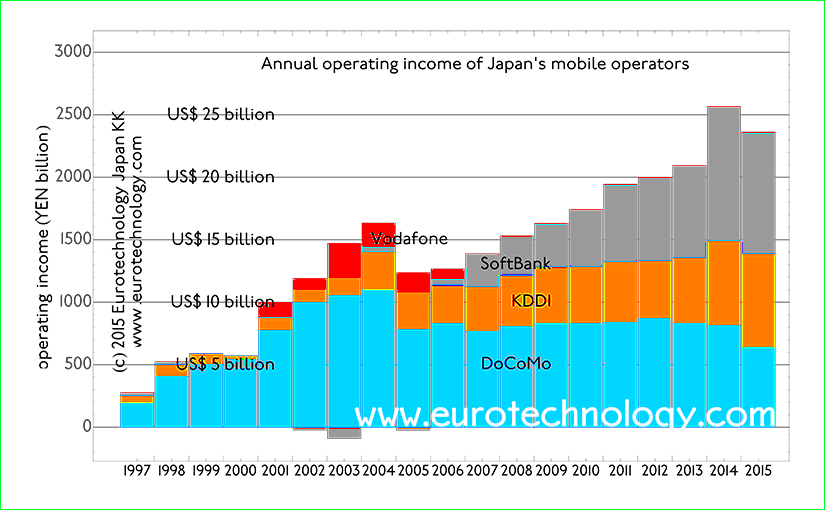

Japan mobile operators grow to US$ 25 billion in operating profits for FY2014 (ended March 31, 2015)

Annual revenues exceed US$ 170 billion in FY2014 Japan’s mobile telecommunications sector continues to grow The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile…

-

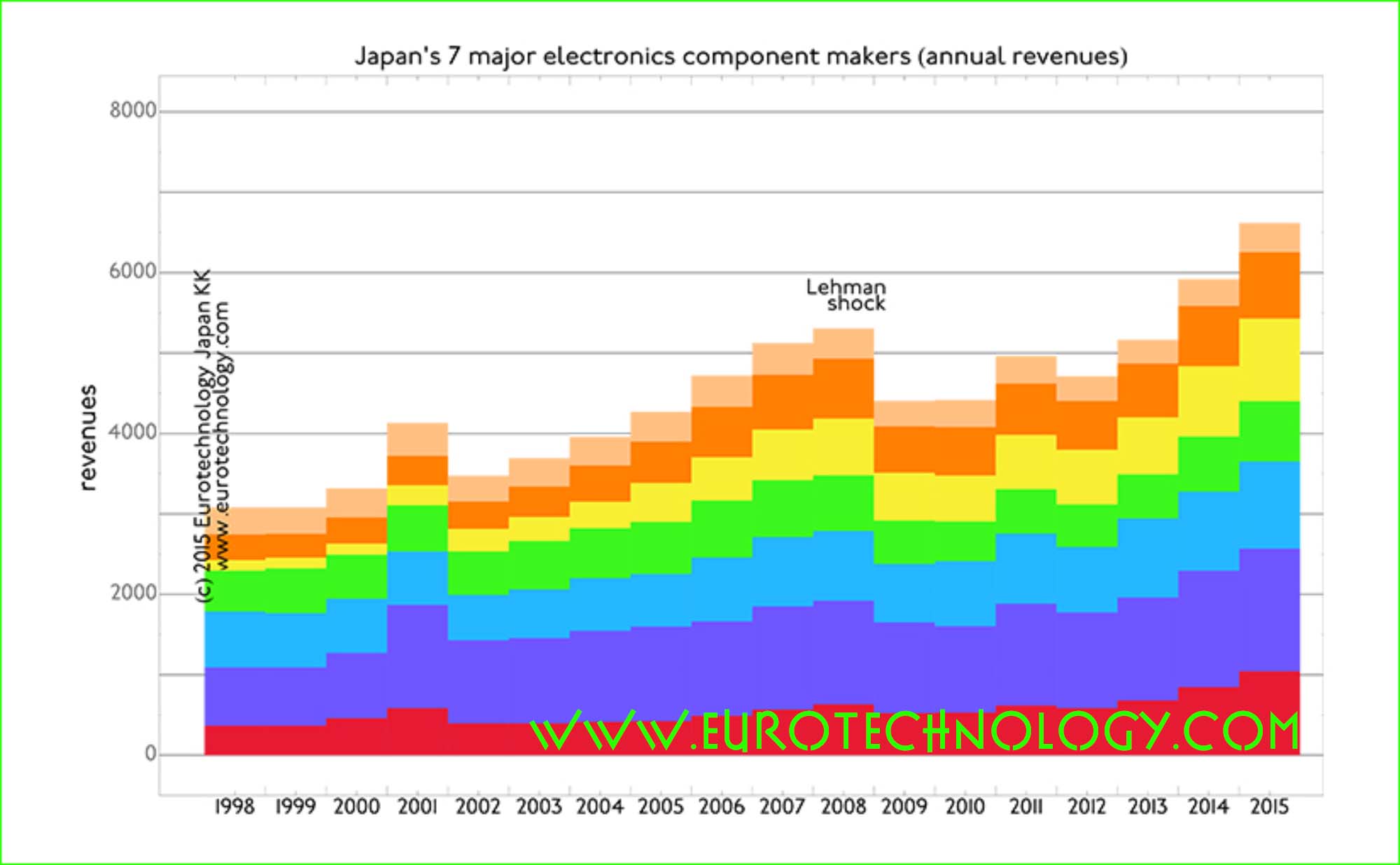

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

Japanese acquisitions in Europe total € 6 billion in 2015

Overcoming Japan’s “Galapagos syndrome” Globalizing Japan’s high-tech industries At the Bank of Kyoto’s New Year celebration meeting, Japan’s stagnation and need for globalization were center of discussion – despite focus on globalization, the present author was more or less the only non-Japanese invited and attending(!). The Chairman of Japan’s Industry Federation KEIDANREN, Mr Sakakibara (Chairman…

-

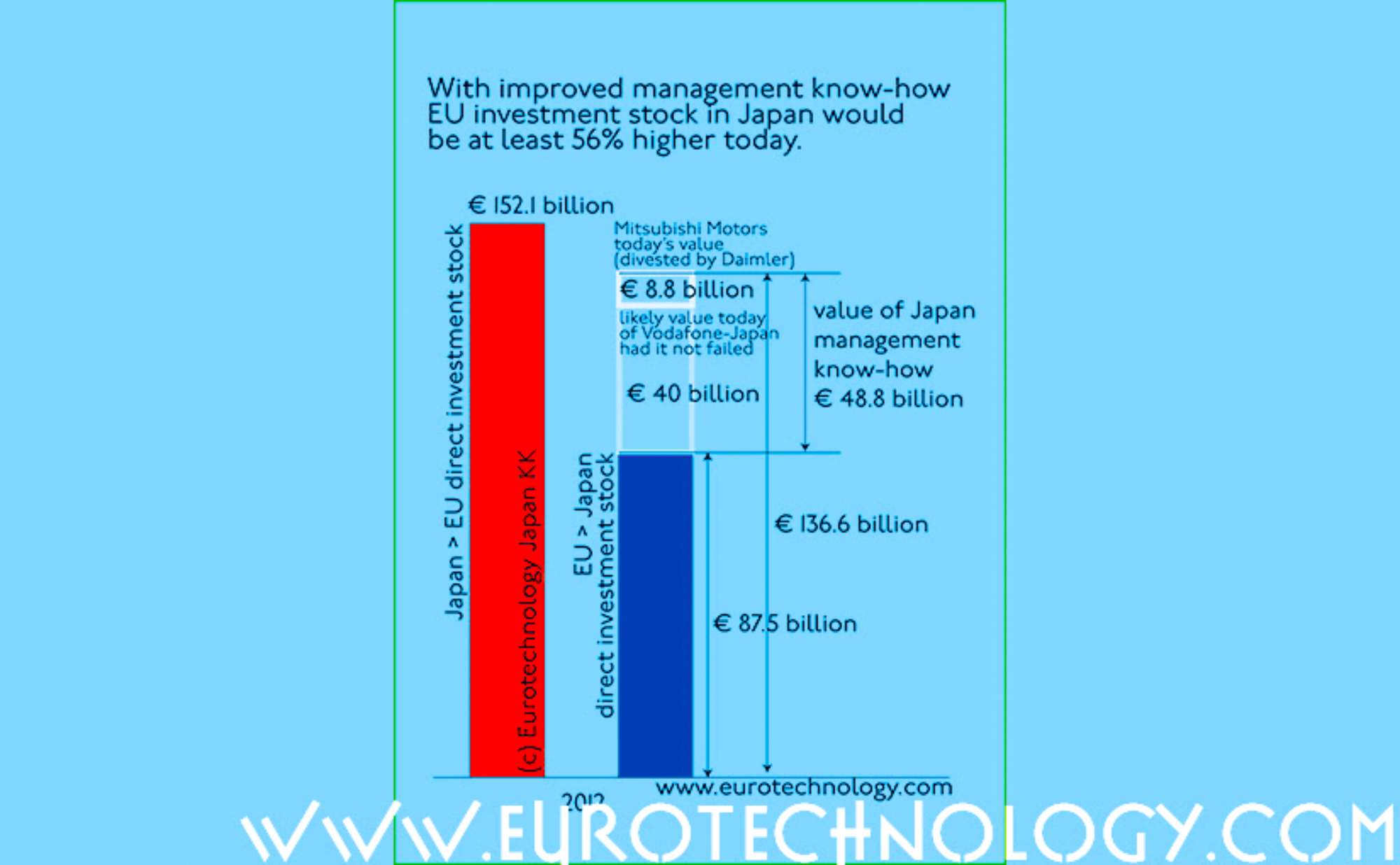

EU Japan management: what is the value of good management in Japan?

EU direct foreign investment into Japan could be 56% higher! With improved management skills, EU owned business in Japan could be at least € 50 billion high than it is today Many companies would wish to have a larger business in Japan, and generally the overall amount of direct EU investment in Japan is considered…

-

Nokia No. 1 in Japan! – Panasonic to sell mobile phone base station division to Nokia

Nokia strengthens No. 1 market position in Japan’s mobile phone base station market! Japan’s mobile phone base station market Japan’s mobile phone base station market is about US$ 2.6 billion/year and for European companies Ericsson and Nokia the most important market globally, although certainly also the most difficult one. Nokia is No. 1 with a…

-

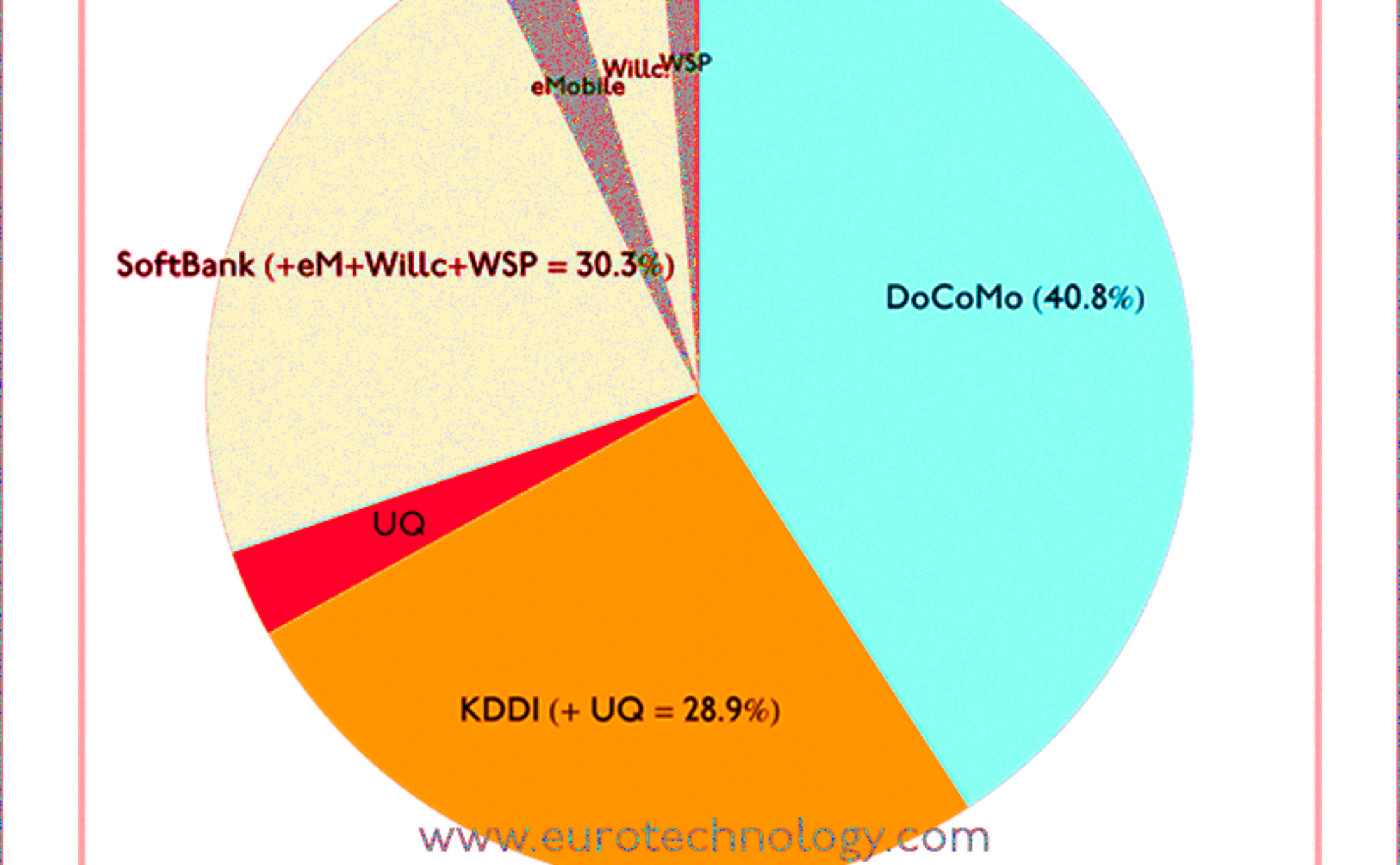

SoftBank market share in Japan – many articles get it wrong. What is SoftBank’s true market share in Japan?

by Gerhard Fasol Many press articles get SoftBank market share in Japan wrong With SoftBank‘s acquisition of US No. 3 mobile operators Sprint and the possibility that Softbank/Sprint will also acquire No. 4 T-Mobile-USA, SoftBank and Masayoshi Son are catching global headlines. SoftBank market share in Japan: Many media articles report wrong data, because they…

-

Israeli Venture Fund Japan meeting in Tokyo March 4, 2014

Start-up Nation Israel 2014 – Israel Japan Investment Funds meeting on March 4, 2014 at the Hotel Okura in Tokyo Israeli Venture funds introduce Israeli ventures to Japanese investors Acquisition of Viber by Rakuten draws attention in Japan to Israeli ventures The recent acquisition of the Israel-based OTT (over the top) communications company Viber by…

-

London Stock Exchange withdraws from Tokyo AIM, Tokyo AIM becomes TOKYO PRO and TOKYO PRO BOND Markets

London Stock Exchange formed the Tokyo AIM market as a joint venture with Tokyo Stock Exchange and now withdraws from this venture and from Japan Initially, London Stock Exchange and Tokyo Stock Exchange created Tokyo-AIM as a joint-venture company in order to create a jointly owned and jointly managed AIM Stock Market in Tokyo, modeled…

-

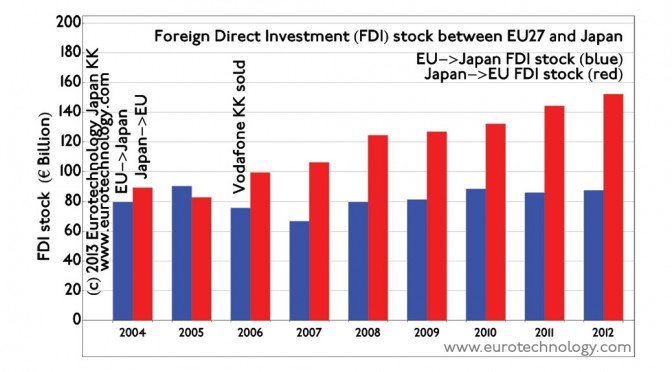

EU Japan investment stock totals about EURO 230 billion and is expected to increase

EU Japan investment stock is expected to increase with the future Economic Partnership Agreement European direct investments into Japan, European acquisitions in Japan EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from…

-

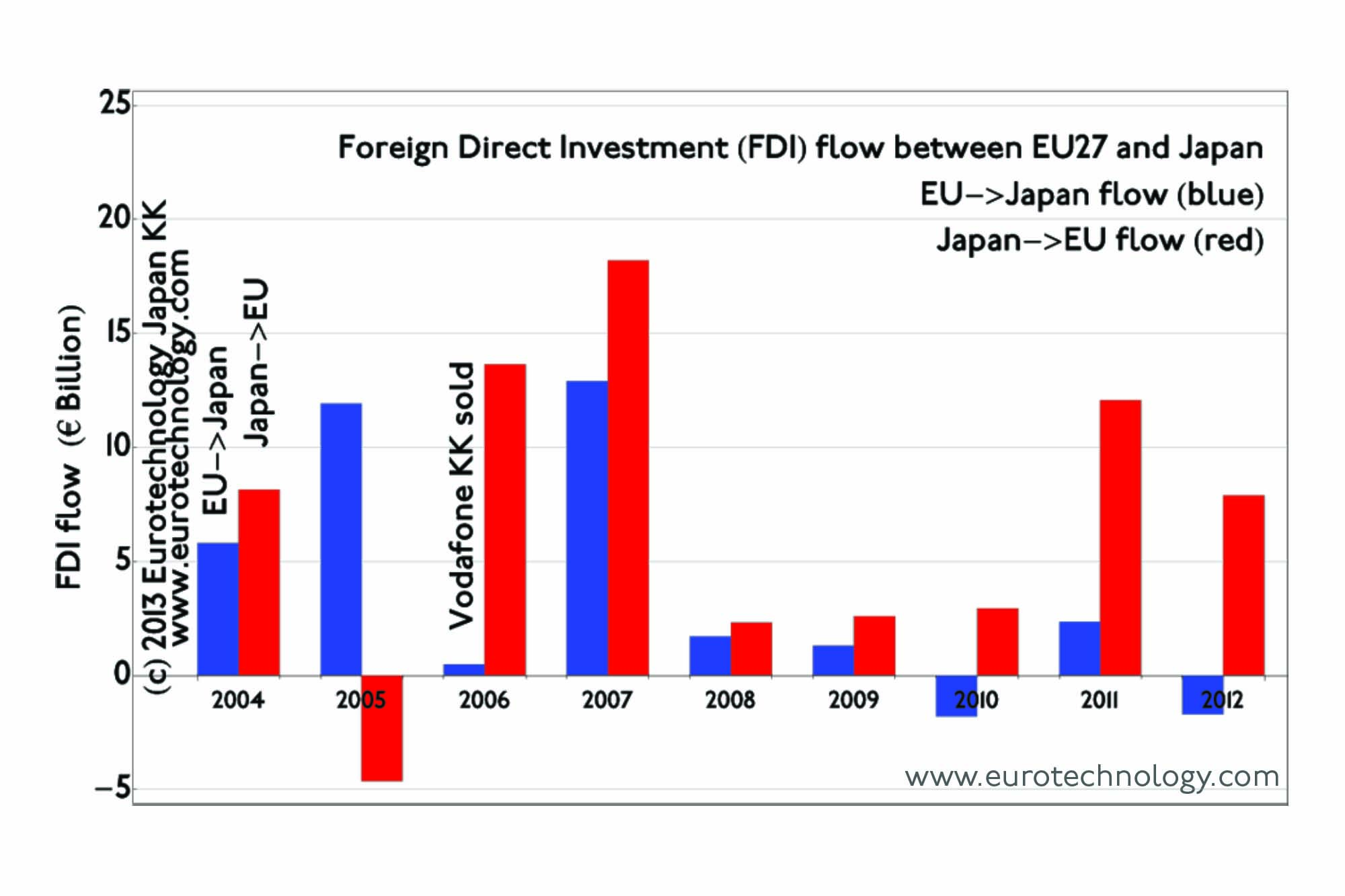

EU Japan investment and acquisition flow and M&A

EU Japan investment flow is mainly from Japan to Europe and totals about EURO 10 billion per year Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn, and was very quiet between 2008 and 2010. In recent years, mainly Japanese investments to Europe have picked up, and currently about…

-

SOMPO, member of the Japanese Insurance group NKSJ Holdings acquires UK reinsurer Canopius Group Ltd

SOMPO, a Japanese insurance company owned by NKSJ Holdings, acquired Canopius in order to globalize In order to globalize, Japanese insurance company Sompo Japan (株式会社損害保険ジャパン), part of the insurance group NKSJ Holdings (NKSJホールディングス株式会社, TSE / JPX: No. 8630) announced yesterday the acquisition of 100% of the UK re-insurer Canopius Group Limited, operating on Lloyd’s for…

-

Japan Perspectives for 2014: can Abenomics succeed? Can Japan grow again? Can Japan solve the population crisis?

Will Abenomics succeed? Stanford Economics Professor Takeo Hoshi thinks that there is a 10% chance that Abenomics will succeed to put Japan on a 2%-3% economic growth path, while the most likely outcome will be 1% economic growth. Read our notes of Professor Hoshi’s talk in detail here. Can Japanese companies globalize? “Globalization” of course…

-

TowerJazz to acquire three of Panasonic’s semiconductor fabs (Nikkei headline)

TowerJazz acquires three of Panasonic’s large written off wafer fabs for around US$ 100 million Massive market entry to Japan for TowerJazz Nikkei (the world’s biggest business daily, see our J-Media report) reported as their top headline yesterday, that TowerJazz is planning to acquire interests in three of Panasonic’s reportedly largely written-off semiconductor fabs valued…

-

“Japanese superman Masayoshi Son” invests in Supercell (interview for Talouselämä, Finland’s largest business newspaper)

“Japanese superman Masayoshi Son” invests in SuperCell – interview with Finland’s largest business newspaper Talouselämä Talouselämä (Finland’s largest business newspaper)’s news editor Mirva Heiskanen interviewed me for their article entitled “Japanese superman Masayoshi Son invests in Supercell” (Supercellin ostaja Masayoshi Son on Japanin supermies). More interviews by Gerhard Fasol. To understand SoftBank better, read our…

-

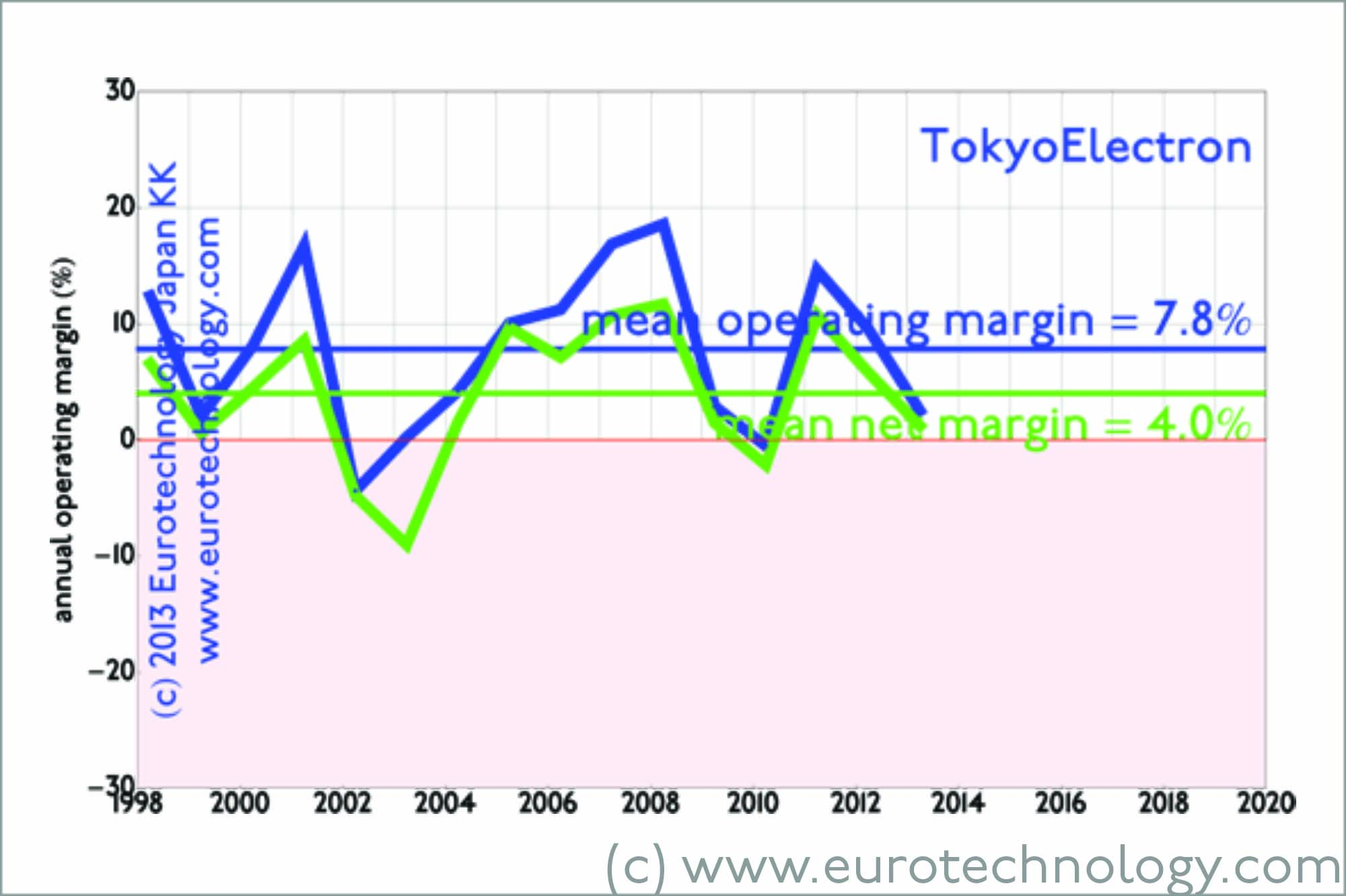

Applied Materials and Tokyo Electron plan merger (BBC interview and comments)

Global No. 1 (Applied Materials) and No. 3 (Tokyo Electron) plan merger Subject to regulatory approval in different jurisdictions Global No. 1 (Applied Materials) and No. 3 (Tokyo Electron) semiconductor manufacturing equipment makers on September 24, 2013 announced their “merger of equals” – creating a company with a nominal market capitalization of US$ 31.5 Billion,…

-

M&A in Japan – interview with Arthur Mitchell by Dr Gerhard Fasol

M&A in Japan: Interview with Arthur Mitchell by Dr Gerhard Fasol M&A in Japan: Many see the current financial crisis as a period of unique opportunities. Several foreign companies are currently entering or seeking to expand business in Japan. At the same time, there is a wave of Japanese acquisitions abroad. Arthur Mitchell is a…

-

Nomura CEO, Kenichi Watanabe speaks about the Lehman Brothers acquisition

Nomura CEO, Kenichi Watanabe, today gave a presentation about the acquisition of the former Lehman Brothers operations in Europe & ME, Japan, Asia (ex-Japan) and in India. Nomura acquired: Europe and ME: Equities and investment banking operations (approx 250 people) Fixed income staff (approx 150 people) Japan: approx. 1100 people Asia (ex-Japan): approx. 1500 people…

-

NSG Pilkington CEO: Four critical factors for Japanese corporates making major international acquisitions

NSG Pilkington CEO, Stuart Chambers, CEO of NSG Group, press conference on October 16, 2008 NSG Pilkington: Nippon Sheet Glass acquired Pilkington in June 2006 On February 16th, 2006, Nippon Sheet Glass‘ offer for the 80% of Pilkington plc it did not already own, for US$ 3.14 billion in total, was accepted by Pilkington’s share…

-

Warren Buffet’s Iscar Ltd of Israel acquired Japanese tungsten carbide tool maker Tungaloy for US$ 1 billion

22 Sept 2008, author Gerhard Fasol The Israeli company Iscar has completed the acquisition of Japanese competitor Tungaloy Corporation. Iscar acquired more than 90% of outstanding shares for around US$ 1 billion from Nomura Principal Finance Co. The acquisition of Tungaloy by Warren Buffet/Berkshire Hathaway’s Iscar was announced on Monday September 22, 2008. Iscar is…

-

NTT-Data expands to Europe: Acquisition of Cirquent GmbH

NTT Data and BMW agreed today, that NTT Data will acquire 72.9% of outstanding shares of Cirquent GmbH NTT Data thus gains BMW as largest customer in Europe Today, August 1, 2008, NTT Data and BMW agreed, that NTT Data will acquire 72.9% of the outstanding shares of Cirquent GmbH in order to globalize. Cirquent…

-

A European perspective on M&A in Japan

Presentation at the lunch meeting of the Danish Chamber of Commerce in Japan (DCCJ) on June 4, 2008. Announcement Photos of the event Announcement text: With the very high EURO and low valuations of many Japanese companies, and with changing attitudes in Japan, now is an excellent time for European companies to start or expand…

-

Seminar in London: "M&A in Japan" (Friday 18 April 2008, 12:30-14:30)

Seminar Description: Two practitioners from Tokyo will debate the changes in Japanese attitudes to mergers and acquisitions. During the course of this seminar, we will cover M&As between Japanese companies, the slow impact of foreign investment into Japan, and the outward investment strategies of Japanese companies. Speakers: Dr Gerhard Fasol, President, Eurotechnology Japan KK David…