Category: Finance

-

How many banks are there in Japan?

Japan’s banking system: Tokyo Banks, Trust Banks, Foreign Banks, Regional Banks – and The Bank of Japan by Gerhard Fasol Japan’s banking system. Number of banks via the Ministry of Finance registration and the Japanese Bankers Association We are often asked, how many banks there are in Japan, when discussing possibilities for obtaining finance. Here…

-

Japan GDP growth and losses at Japan Post – Gerhard Fasol interviewed by Rico Hizon on BBC TV

Japan’s economy grows five quarters in a row, and Japan Post books losses of YEN 400.33 billion (US$ 3.6 billion) for an acquisition in Australia Japan GDP growth, growth of 2%/year. Still, Japan’s economy is the same size as in 2000, while countries like France, Germany, UK today are double the size as in the…

-

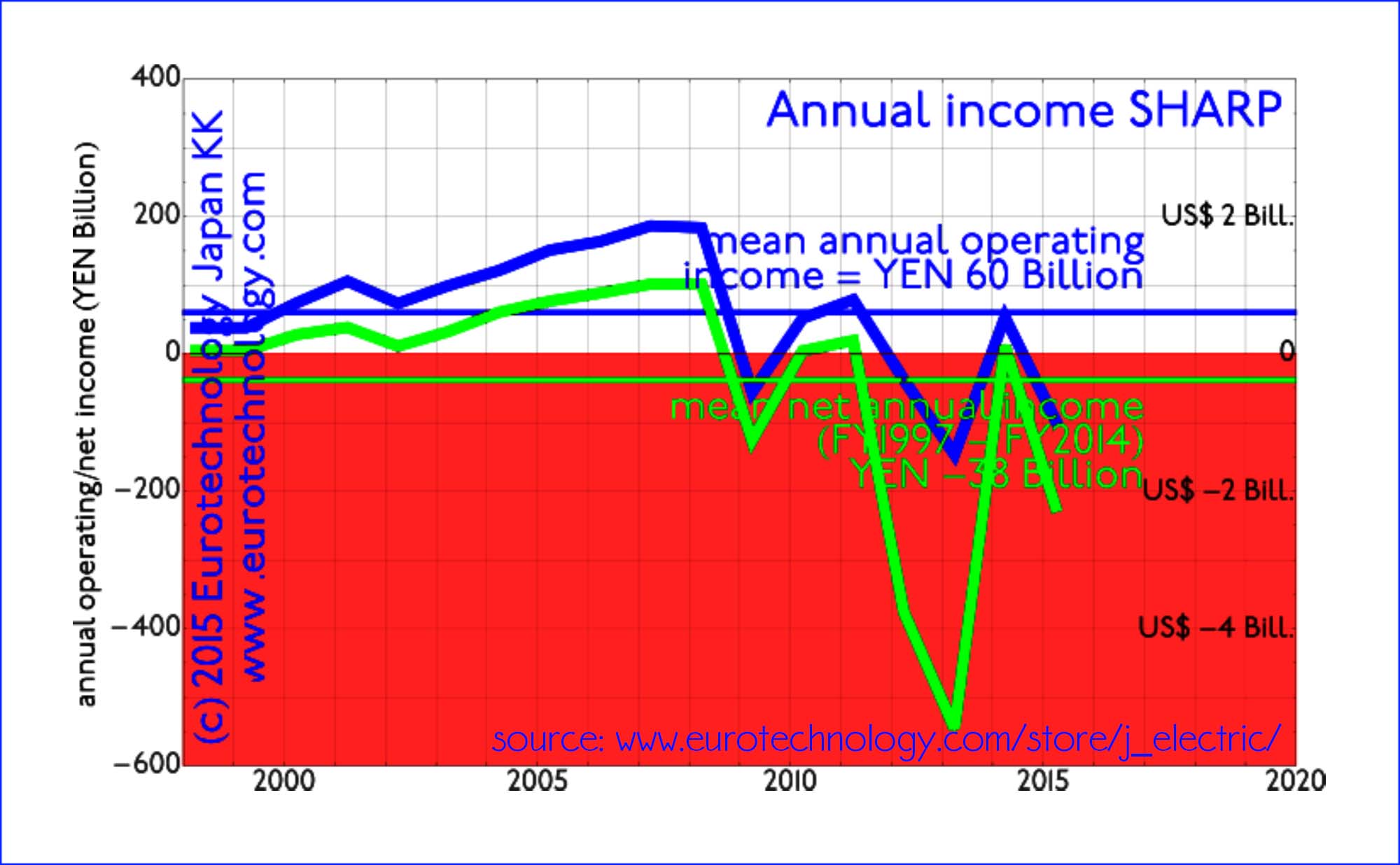

SHARP and the future of Japan’s electronics

SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector The need for focus and active portfolio management SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March. Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete…

-

Economic growth for Japan? A New Year 2016 preview

Economic growth for Japan in 2016? Economic growth: Almost everyone agrees that economic growth is preferred over stagnation and decline. Fiscal policy and printing money unfortunately can’t deliver growth. Building fresh new successful companies, returning stagnating or failed established companies back to growth (see: “Speed is like fresh food” by JVC-Kenwood Chairman Kawahara), and adjusting…

-

Corporate governance reforms in Japan – practical views of a Board Director

A Board Director’s view Corporate governance reforms in Japan progress faster than even one of their key promoters expected, and cost almost no tax payers money Author: Gerhard Fasol Corporate governance reforms in Japan are one component of “Abenomics” to bring back economic growth to Japan. Corporate governance reforms in Japan are driven at least…

-

Quarterly financial reports to go away: UK and EU remove requirements for quarterly financial reports

Voluntary quarterly reporting? Quarterly financial reports: can they be the trees which obscure long term growth of the forrest? As a Board Director of a Japanese company traded on the Tokyo Stock Exchange I have to study and approve monthly, quarterly and annual financial reports, and I share responsibility for the future success of the…

-

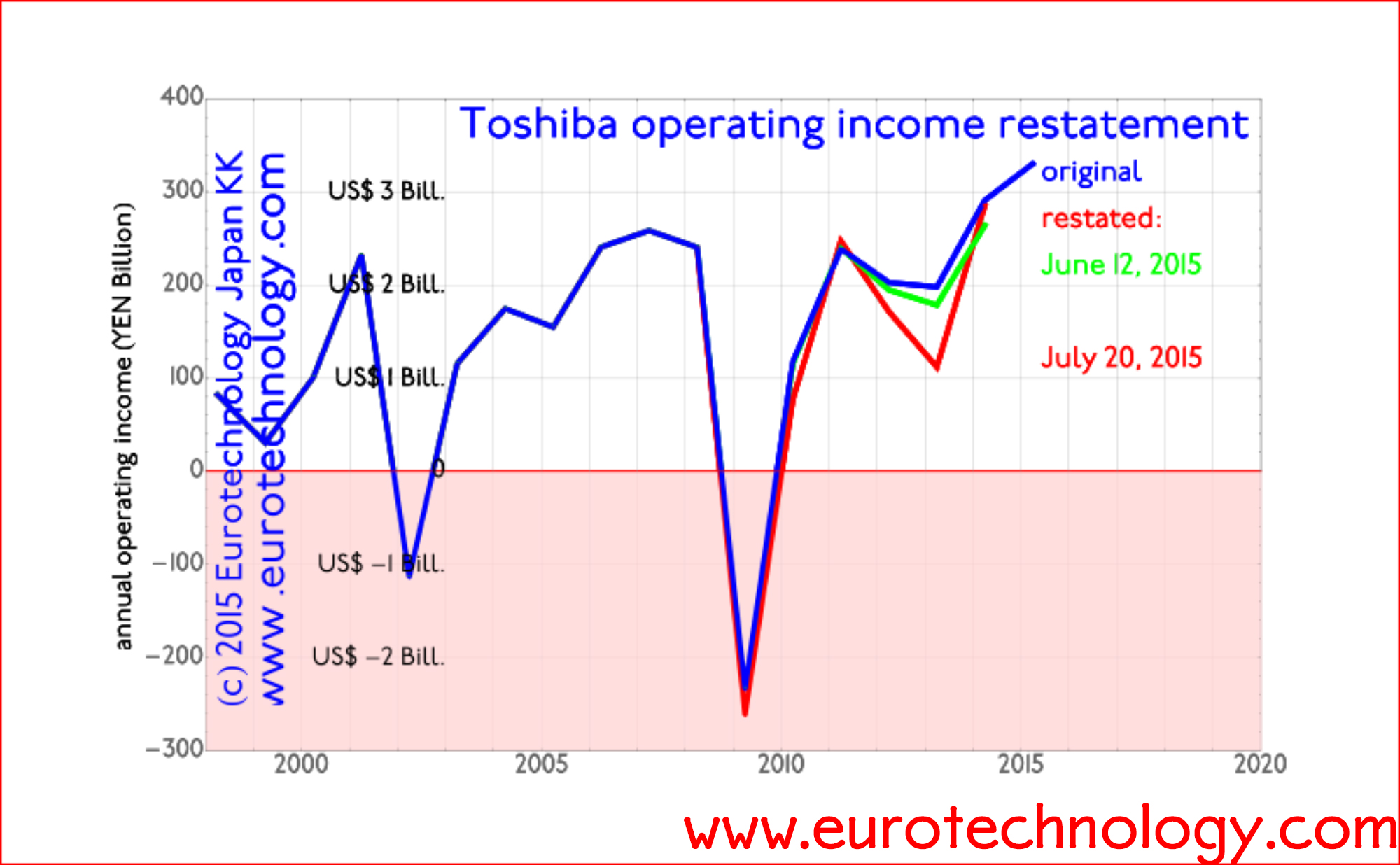

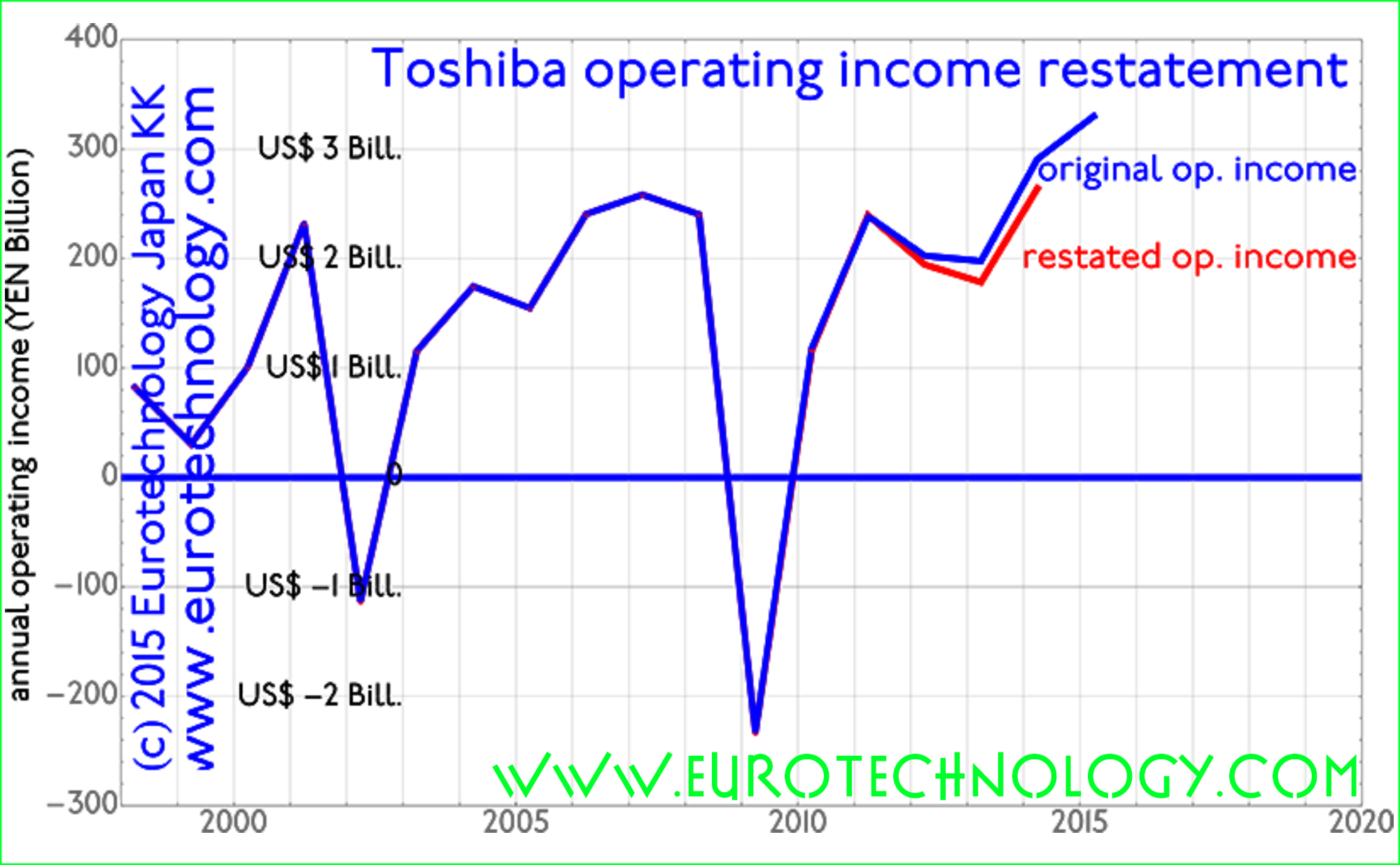

Toshiba income restatement: corresponds to one full year of average operating income

Toshiba’s income restatement announced by the independent 3rd party committee by Gerhard Fasol Independent 3rd party committee chaired by former Chief Prosecutor of Tokyo High Court On 12 June, 2015, Toshiba announced corrections to income reports, and at the same time engaged an independent 3rd party investigation committee headed by former Chief Prosecutor at the…

-

Toshiba accounting restatements in context

July 21, 2015: Update – report of the independent 3rd party committee chaired by former Chief Prosecutor of the Tokyo High Court. Corrections amount to 2 1/2 years (31.5 months) of average annual net profits by Gerhard Fasol Sales stagnation combined with almost zero net profit of Japan’s top 8 electronics companies creates increasing pressure…

-

Japan Exchange Group CEO Atsushi Saito: proud of Corporate Governance achievements, but ashamed of Toshiba

New Dimensions of Japanese Financial Market Only with freedom and democracy, the values of open society and professionalism can the investment chain function effectively The iconic leader of the Tokyo Stock Exchange since 2007, now Group CEO of the Japan Exchange Group gave a Press Conference at the Foreign Correspondents Club of Japan on June…

-

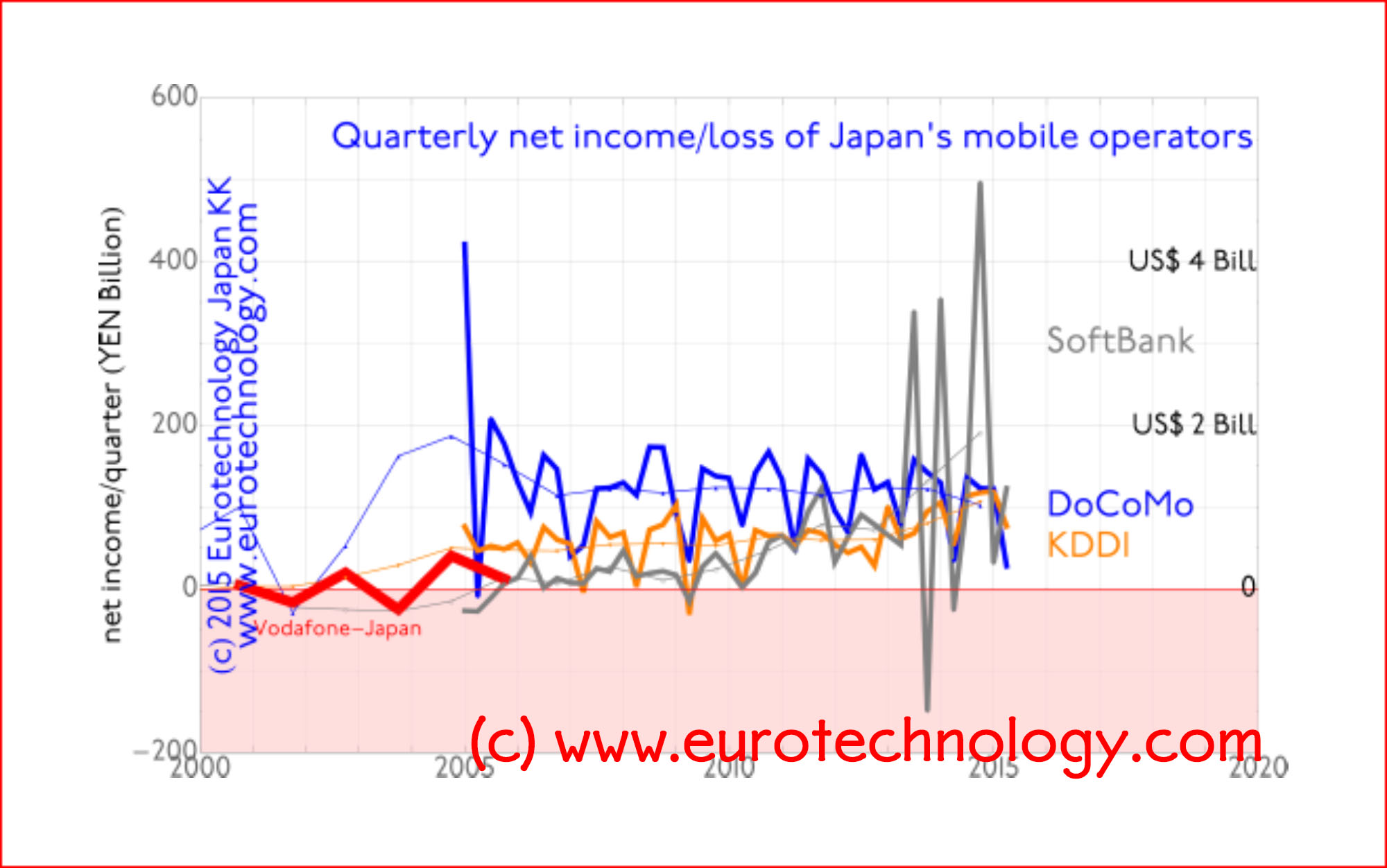

Apple Pay vs Japan’s Osaifu-keitai – the precursor to Apple Pay

What can we learn from 10+ years of mobile payments in Japan? Apple Pay vs Japan’s Osaifu-Keitai: watch the interview on CNBC https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html?play=1 Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) Japan’s Osaifu keitai mobile payments started on July 10, 2004, after public testing during December 2003 – June 2004 Two different…

-

Israeli Venture Fund Japan meeting in Tokyo March 4, 2014

Start-up Nation Israel 2014 – Israel Japan Investment Funds meeting on March 4, 2014 at the Hotel Okura in Tokyo Israeli Venture funds introduce Israeli ventures to Japanese investors Acquisition of Viber by Rakuten draws attention in Japan to Israeli ventures The recent acquisition of the Israel-based OTT (over the top) communications company Viber by…

-

London Stock Exchange withdraws from Tokyo AIM, Tokyo AIM becomes TOKYO PRO and TOKYO PRO BOND Markets

London Stock Exchange formed the Tokyo AIM market as a joint venture with Tokyo Stock Exchange and now withdraws from this venture and from Japan Initially, London Stock Exchange and Tokyo Stock Exchange created Tokyo-AIM as a joint-venture company in order to create a jointly owned and jointly managed AIM Stock Market in Tokyo, modeled…

-

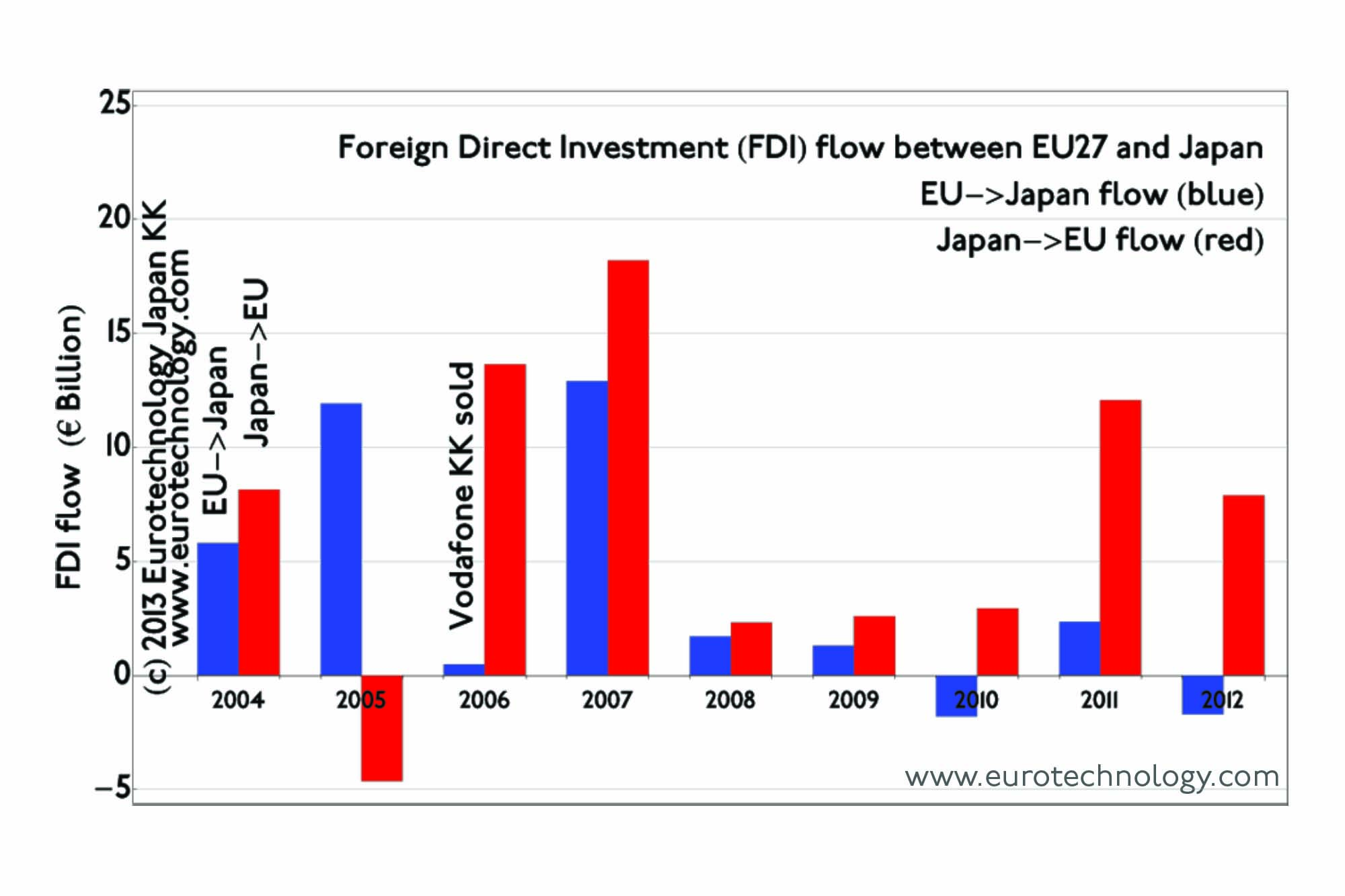

EU Japan investment and acquisition flow and M&A

EU Japan investment flow is mainly from Japan to Europe and totals about EURO 10 billion per year Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn, and was very quiet between 2008 and 2010. In recent years, mainly Japanese investments to Europe have picked up, and currently about…

-

SOMPO, member of the Japanese Insurance group NKSJ Holdings acquires UK reinsurer Canopius Group Ltd

SOMPO, a Japanese insurance company owned by NKSJ Holdings, acquired Canopius in order to globalize In order to globalize, Japanese insurance company Sompo Japan (株式会社損害保険ジャパン), part of the insurance group NKSJ Holdings (NKSJホールディングス株式会社, TSE / JPX: No. 8630) announced yesterday the acquisition of 100% of the UK re-insurer Canopius Group Limited, operating on Lloyd’s for…

-

Japan Perspectives for 2014: can Abenomics succeed? Can Japan grow again? Can Japan solve the population crisis?

Will Abenomics succeed? Stanford Economics Professor Takeo Hoshi thinks that there is a 10% chance that Abenomics will succeed to put Japan on a 2%-3% economic growth path, while the most likely outcome will be 1% economic growth. Read our notes of Professor Hoshi’s talk in detail here. Can Japanese companies globalize? “Globalization” of course…

-

How many banks are there in Japan? and financial industry trends

Japan’s banking system: Tokyo Banks, Trust Banks, Foreign Banks, Regional Banks – and The Bank of Japan by Gerhard Fasol Japan banks need to register with the Ministry of Finance, so we know exactly how many banks there are in Japan, and we know address and all details about each one (contact us if you…

-

Tokyo PRO: LSE’s Tokyo AIM stock market rebirth under TSE alone?

Tokyo PRO: NIKKEI reports that LSE fails in the same way in Japan as NASDAQ 10 years earlier. London Stock Exchange withdraws from Tokyo AIM and quits Japan Tokyo-AIM (the stock market joint venture between Tokyo Stock Exchange and London Stock Exchange) seems to be heading along a similar road as NASDAQ-Japan about 10 years…

-

Will cash become obsolete?

Gave presentation to the Telecommunications Committee of the American Chamber of Commerce in Japan (ACCJ) on October 7, 2009, entitled “Will cash become obsolete? E-money, mobile payments and mobile commerce”. Talk was attended by about 30-40 executives from major global telecom operators, global banks, new-age payment companies, and from major internet companies. Outline: What is…

-

Waking the world’s largest bank: Japan Post

Japan Post (JP), the world’s largest bank & insurer by assets became a group of private companies on October 1, 2007. Japan Post manages about US$ 3.3 Trillion in assets, about 40% more than Citigroup or HSBC and about 12 times more than the banking arm of Germany’s Deutsche Post. Privatization of Japan Post would…

-

Panel Discussion to 200 Japanese Executives at the Industrial Club of Japan

May 30, 2006: at the Industrial Club of Japan Panel discussion for about 200 Japanese CEOs and high level managers about the challenges of international business management. The five panelists were: James C AbbeglenAllen Miner (CEO of Sunbridge Venture Habitat, and founder of Oracle Japan) Kong Jian (China – Japan Economic Federation) Koshiro Kitazato (Chairman…

-

30 Swedish Controllers / CFO’s

by Gerhard Fasol April 24, 2006 was my Swedish Day: for breakfast I was invited to IKEA’s opening party for their new store in Funabashi (I met even with the global Chairman of IKEA – that he attended the opening in Funabashi shows how seriously IKEA is taking this (second) market entry to Japan) –…

-

About Tokyo Stock Exchange Turbulence on CNBC and RedHerring

Wednesday January 18, 2006 I was interviewed live on CNBC’s “Worldwide Exchange” news program about the turbulence on the Tokyo Stock Exchange following lower than expected quarterly earning reports by Intel, Yahoo and IBM, and a sell-off of Livedoor shares. Here is a summary of what I said in the interview: Overall I am very…