Category: Economics

-

Struggling for Europe’s technology sovereignty – a comment on Hermann Hauser’s proposal for a €100 billion Technology Sovereignty Fund

by Gerhard Fasol Hermann Hauser in a recent article on Project Syndicate, entitled “The Struggle for Technology Sovereignty in Europe” argues for “the UK and EU to jointly establish a €100 billion ($120 billion) Technology Sovereignty Fund to counter the $100 billion that the US is spending on its technology sovereignty and the even larger…

-

EFTA Court – impact on business and our emerging new world order: former EFTA Court President Carl Baudenbacher

Former President of the EFTA Court, Carl Baudenbacher Gerhard Fasol: Professor Baudenbacher, could you explain in simple terms, what the EFTA Court and your work leading the EFTA Court for many years, means for businesses in Europe, and also businesses in Japan. Carl Baudenbacher: The EFTA Court is the second tribunal in the European Economic…

-

EU-Japan Free Trade Agreement (FTA) and Economic Partnership Agreement (EPA) closer to conclusion

With US withdrawal from TPP and BREXIT, the EU-Japan Free Trade Agreement moves to the center of attention EU-Japan Free Trade Agreement and Economic Partnership Agreement nearing conclusion, maybe this summer. EU and Japan started to prepare for Free Trade Agreement (FTA) and the political framework Economic Partnership Agreement (EPA) at the 20th EU-Japan Summit…

-

Japan GDP growth and losses at Japan Post – Gerhard Fasol interviewed by Rico Hizon on BBC TV

Japan’s economy grows five quarters in a row, and Japan Post books losses of YEN 400.33 billion (US$ 3.6 billion) for an acquisition in Australia Japan GDP growth, growth of 2%/year. Still, Japan’s economy is the same size as in 2000, while countries like France, Germany, UK today are double the size as in the…

-

Bill Emmott and Gerhard Fasol – A conversation about Japan’s future

Bill Emmott and Gerhard Fasol Bill Emmott is an independent writer and consultant on international affairs, board director, and from 1993 until 2006 was editor of The Economist. http://www.billemmott.com Gerhard Fasol is physicist, board director, entrepreneur, M&A advisor in Tokyo. http://fasol.com/ A conversation about Japan’s future Bill Emmott: I came first to Japan in 1983…

-

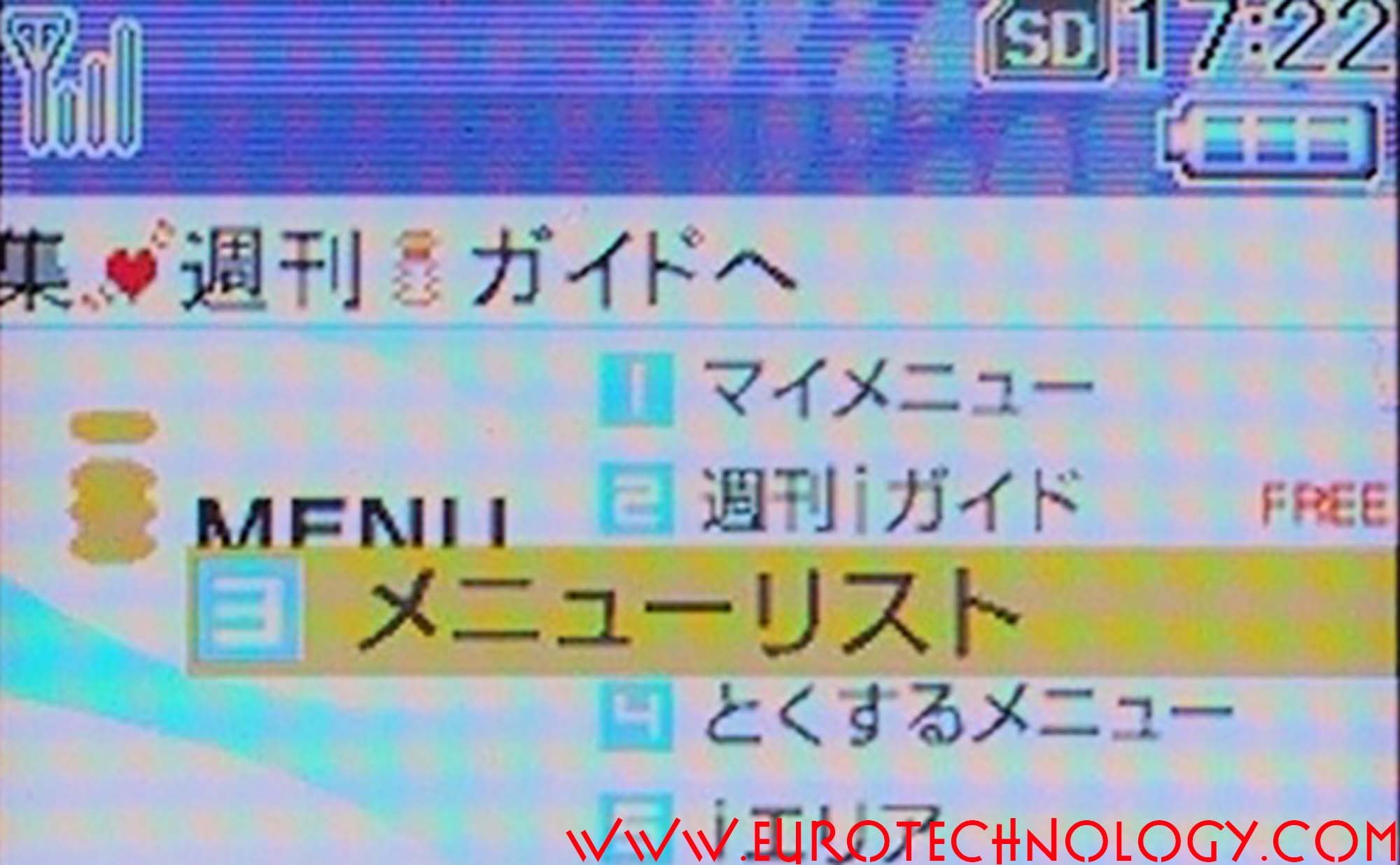

Mobile internet coming of age: i-Mode’s 18th birthday

The global mobile internet was born today 18 years ago, on February 22, 1999 by Gerhard Fasol NTT Docomo announced the start of i-Mode on February 22, 1999 at a press conference in Tokyo Today, 18 years ago, on February 22, 1999, Mari Matsunaga, Takeshi Natsuno, and Keiichi Enoki announced the start of the world’s…

-

Toshiba nuclear write-off. BBC interview about Toshiba’s latest nuclear industry write-offs

Toshiba is expected to announce write-off provisions on the order of US$ 6 billion today Toshiba is on Tokyo Stock Exchange warning list for possible delisting in March 2017 by Gerhard Fasol This morning 7:30am I was interviewed on BBC TV Asia Business Report about an update of Toshiba’s ongoing crisis, which has been 20…

-

Mobile internet’s 17th birthday

The global mobile internet revolution started with Docomo’s i-Mode on February 22, 1999 i-Mode, Happy Birthday! Today, exactly 17 years ago, on February 22, 1999, NTT-Docomo launched the world’s first mobile internet service, i-Mode, at a press conference attended only by a handful of people. NTT-Docomo created the foundation of the global mobile internet revolution,…

-

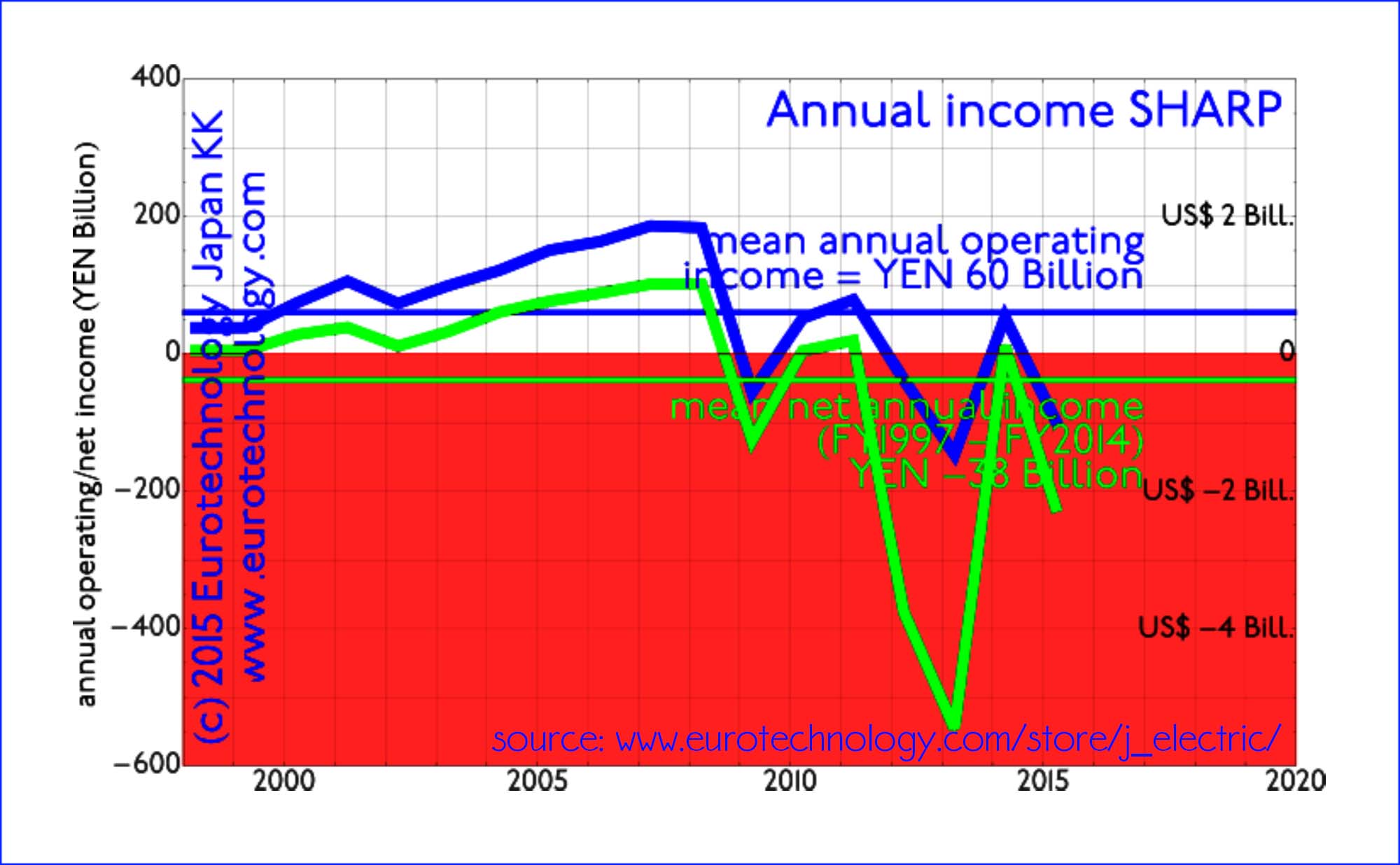

SHARP and the future of Japan’s electronics

SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector The need for focus and active portfolio management SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March. Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete…

-

Economic growth for Japan? A New Year 2016 preview

Economic growth for Japan in 2016? Economic growth: Almost everyone agrees that economic growth is preferred over stagnation and decline. Fiscal policy and printing money unfortunately can’t deliver growth. Building fresh new successful companies, returning stagnating or failed established companies back to growth (see: “Speed is like fresh food” by JVC-Kenwood Chairman Kawahara), and adjusting…

-

Corporate governance reforms in Japan – practical views of a Board Director

A Board Director’s view Corporate governance reforms in Japan progress faster than even one of their key promoters expected, and cost almost no tax payers money Author: Gerhard Fasol Corporate governance reforms in Japan are one component of “Abenomics” to bring back economic growth to Japan. Corporate governance reforms in Japan are driven at least…

-

Japan Exchange Group CEO Atsushi Saito: proud of Corporate Governance achievements, but ashamed of Toshiba

New Dimensions of Japanese Financial Market Only with freedom and democracy, the values of open society and professionalism can the investment chain function effectively The iconic leader of the Tokyo Stock Exchange since 2007, now Group CEO of the Japan Exchange Group gave a Press Conference at the Foreign Correspondents Club of Japan on June…

-

Japan in 2015 – analysis

Thoughts and analysis for 2015 Abenomics?! The trick of course is the third arrow, the reforms. Read what Professor Takeo Hoshi has to say about Abenomics, Japanese economist, who has worked his way up US Universities, and has now reached the position of Professor of Economics at Stanford University. By the way, here is my…

-

EU Japan FTA

Free Trade Agreement (FTA) and Economic Partnership Agreement (EPA) Preparations: EU Japan FTA trade negotiations initiated: At the 20th EU-Japan Summit of May 2011 the EU and Japan decided to start preparations for both a Free Trade Agreement (FTA) and a political framework agreement (Economic Partnership Agreement, EPA). For updates and further details see: http://eu-japan.com/eu-japan-agreements/eu-japan-trade-negotiations/…

-

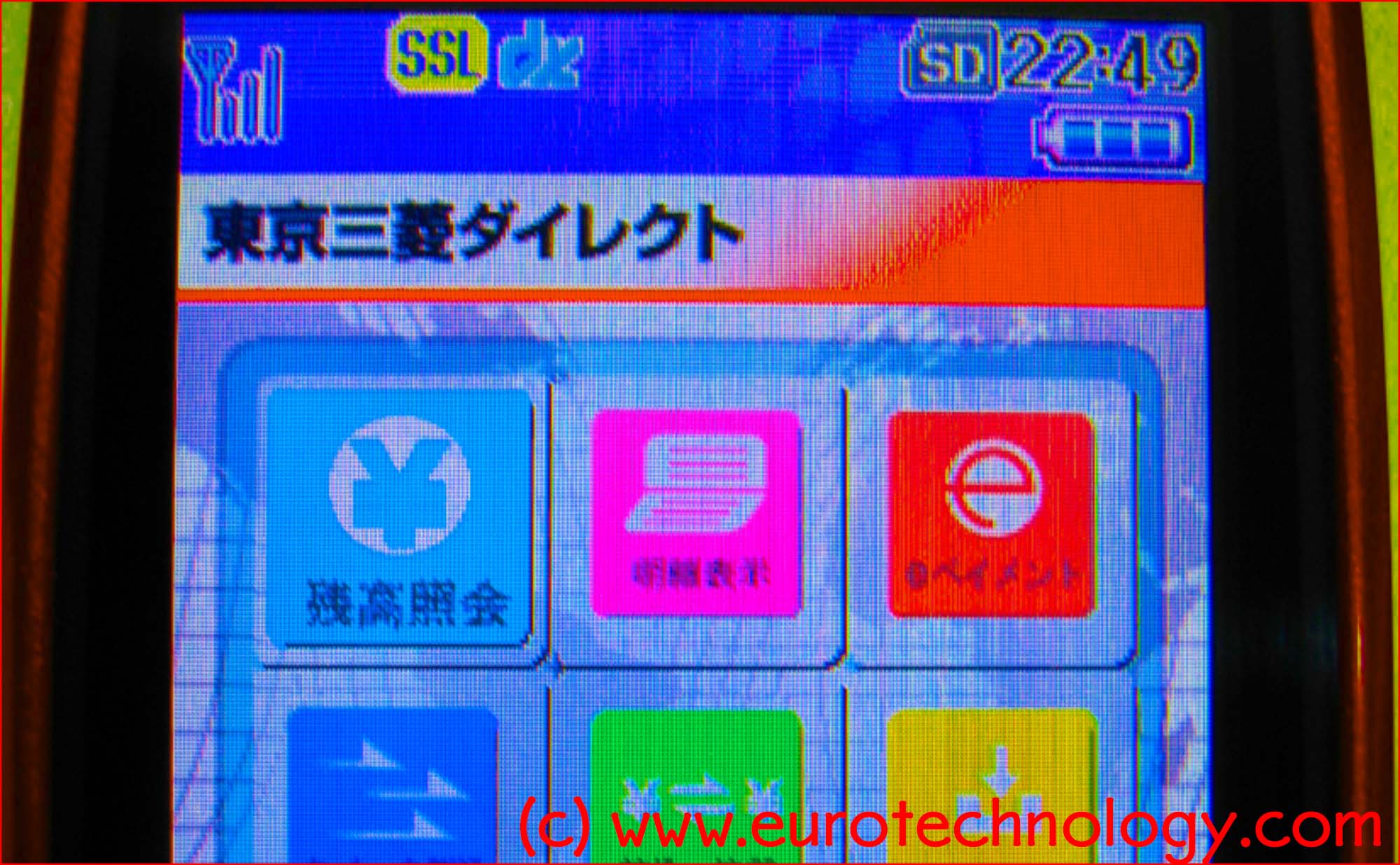

ApplePay vs Osaifu-Keitai – CNBC interview

ApplePay is expected to start in October 2014 – Docomo’s Osaifu-keitai wallet phones started on July 10, 2004. https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) In business the first-comer does not always win the game Japan’s NTT-Docomo tested two types of wallet phones, manufactured by Panasonic and SONY with 5000…

-

Apple Pay vs Japan’s Osaifu-keitai – the precursor to Apple Pay

What can we learn from 10+ years of mobile payments in Japan? Apple Pay vs Japan’s Osaifu-Keitai: watch the interview on CNBC https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html?play=1 Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) Japan’s Osaifu keitai mobile payments started on July 10, 2004, after public testing during December 2003 – June 2004 Two different…

-

Japan’s electricity and new energy policy

Stockholm School of Economics at the Embassy of Sweden in Tokyo (Alfred Nobel Lecture Theatre) European Institute for Japanese Studies EIJS Announcement and summary on the website of Stockholm School of Economics. This talk is based on data from our reports: European Institute of Japanese Studies (EIJS) Academy Seminars About the talk: Japan’s electricity architecture…

-

Steve Jobs and SONY: why do Steven Jobs and SONY reach opposite answers to the same question: what to do with history?

Steve Jobs and SONY: why 180 degrees opposite decisions? Steve Jobs donates history to Stanford University in order to focus on the future Steve Jobs and SONY – when Steve Jobs when returned to Apple in 1996, and now SONY are faced with the same question: what to do about corporate archives and the corporate…

-

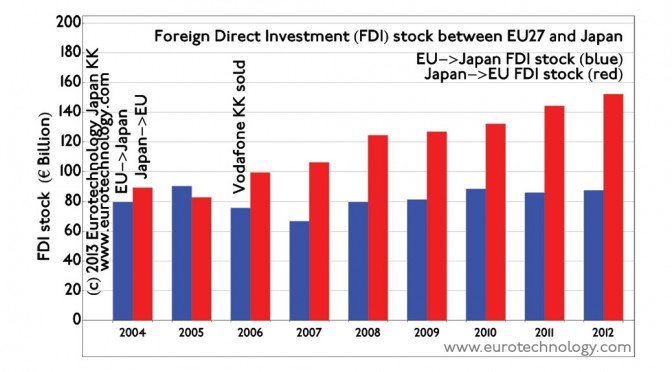

EU Japan investment stock totals about EURO 230 billion and is expected to increase

EU Japan investment stock is expected to increase with the future Economic Partnership Agreement European direct investments into Japan, European acquisitions in Japan EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from…

-

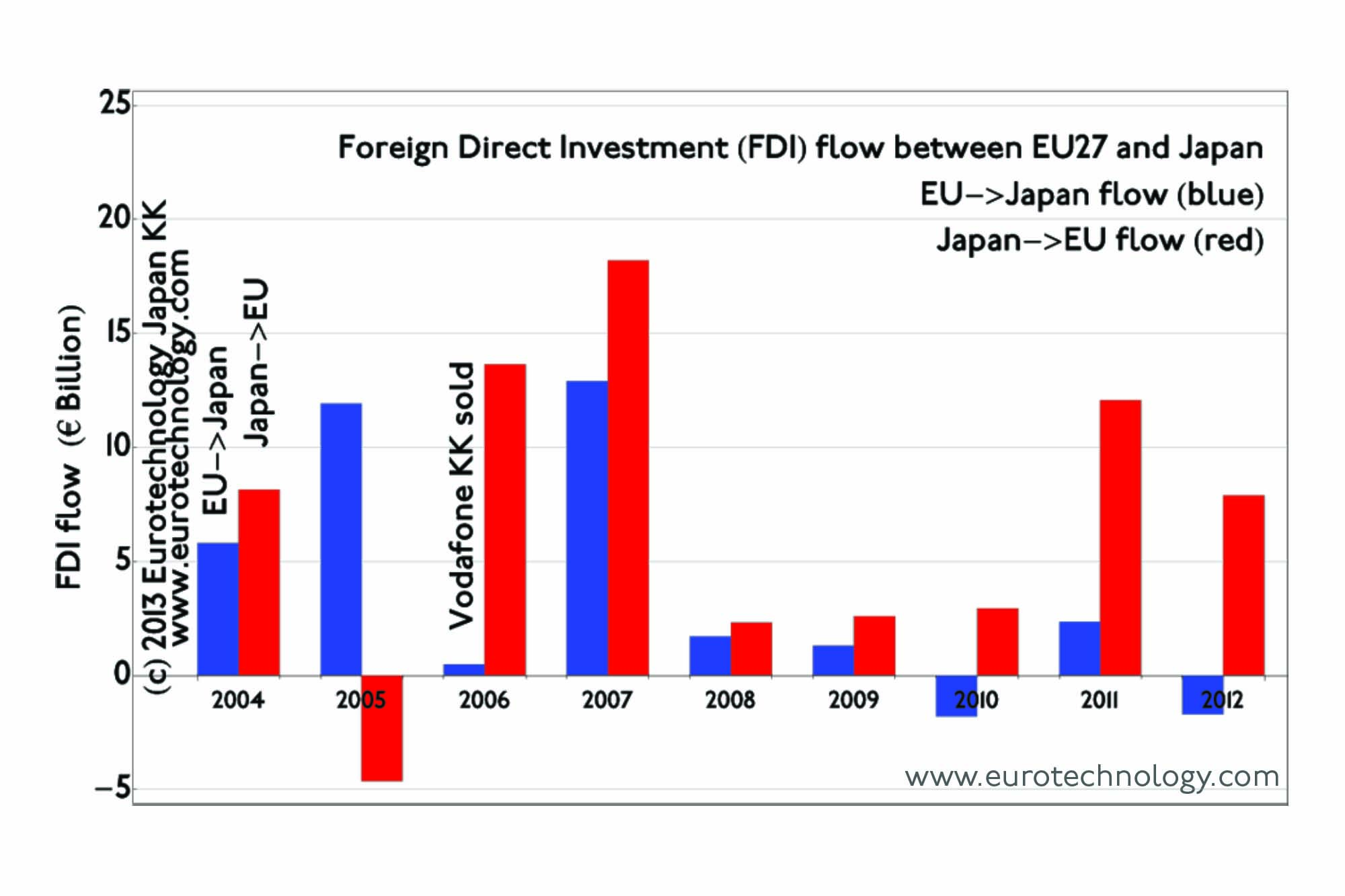

EU Japan investment and acquisition flow and M&A

EU Japan investment flow is mainly from Japan to Europe and totals about EURO 10 billion per year Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn, and was very quiet between 2008 and 2010. In recent years, mainly Japanese investments to Europe have picked up, and currently about…

-

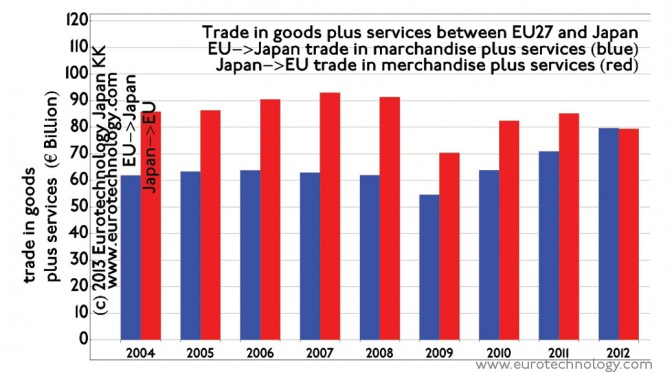

EU Japan trade totals about EURO 160 billion/year and is expected to increase with the future Economic Partnership Agreement

EU Japan trade adds up to about EURO 160 billion/year if both directions are added up Combining the amounts of trade for merchandise and commercial services, EU exports to Japan and Japanese exports to EU have reached equal levels, so that the trade between EU and Japan is now balanced around EURO 80 billion in…

-

Scandinavian renewable energy conference in Tokyo

Was invited to attend the Scandinavian renewable energy conference in Tokyo. Topics covered: Electricity infrastructure, market and governance Electricity market reform in Japan Power of network and for green growth – learning from nordic experiences Nordic renewable energy sources Nordic solution for bio energy production Bioenergy from blue biomass Nordic way to increase efficiency of…

-

Rakuten vs SoftBank + Yahoo vs Amazon (Bloomberg and BusinessWeek interviews)

Rakuten vs Softbank Yahoo reduces e-commerce fees to compete harder with Rakuten’s online mall Bloomberg interview and BusinessWeek interview about Yahoo KK’s aggressive reduction of ecommerce fees, a move increasing competition with Amazon.com and Rakuten. How do you see Yahoo KK’s latest move to reduce or eliminate merchant’s fees? Do you see this as an…

-

Japan’s Galapagos Effect

How Japan can capture global value from its innovations – a talk by Gerhard Fasol Dr. Gerhard Fasol dissects the history behind Japan’s unique international market separation By Hugh Ashton Originally published both in the print and online editions of the ACCJ Journal (Journal of the American Chamber of Commerce in Japan) on January 15,…

-

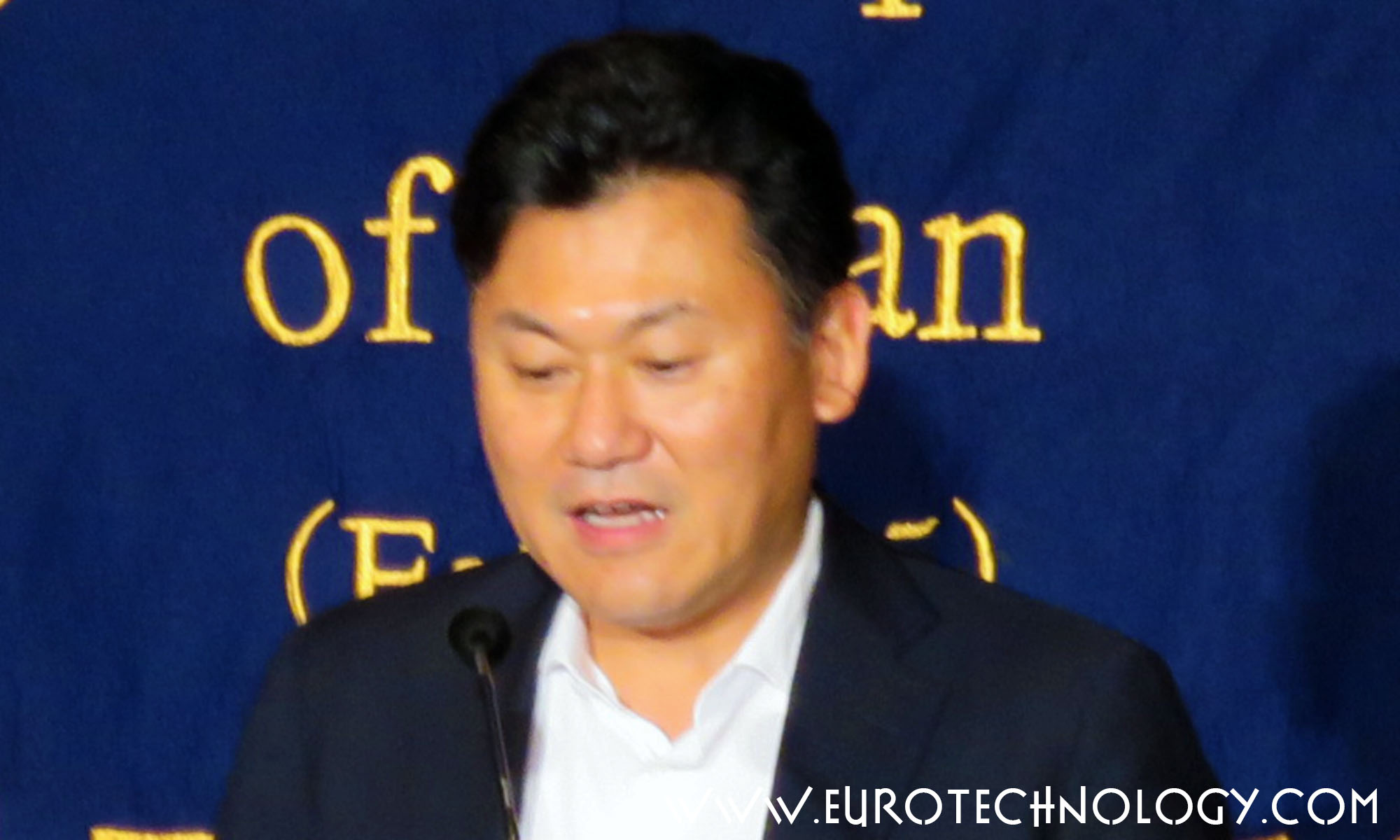

Hiroshi Mikitani about the Japan Association of New Economy (JANE)

Hiroshi Mikitani about how Japan should become more competitive Hiroshi Mikitani: presentation of his new book = Competitiveness Today Hiroshi Mikitani, Founder and Chairman of Rakuten, gave a talk at the Foreign Correspondents Club about his Japan Association of New Economy (JANE) and about his new book authored with his father entitled Competitiveness. Mikitani is…

-

How many banks are there in Japan? and financial industry trends

Japan’s banking system: Tokyo Banks, Trust Banks, Foreign Banks, Regional Banks – and The Bank of Japan by Gerhard Fasol Japan banks need to register with the Ministry of Finance, so we know exactly how many banks there are in Japan, and we know address and all details about each one (contact us if you…

-

Japan Galapagos effect (Galapagos syndrome)

Japan Galapagos effect Autor: Gerhard Fasol Globalizing Japan On the Galapagos islands, Charles Darwin noticed a number of species which were extremely beautiful, had evolved on the Galapagos islands locally, and were not able to live anywhere else. Similarly, due to language, culture, comparatively small interchange between Japan’s markets and foreign markets, some technologies and…

-

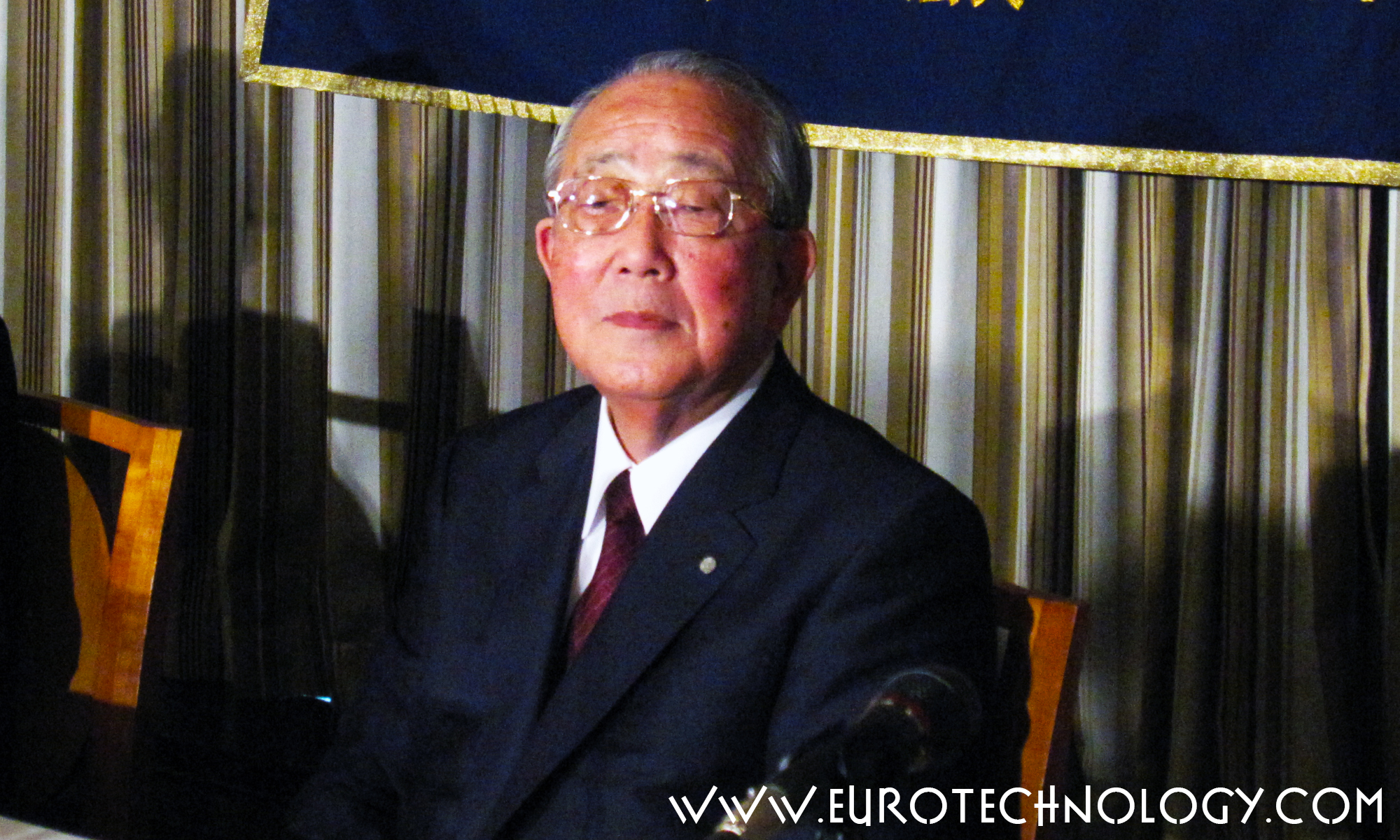

Kazuo Inamori, founder of Kyocera and DDI (KDDI), rebuilds Japan Airlines using Amoeba Management (アメーバ経営)

Kazuo Inamori (稲盛 和夫) one of Japan’s legendary serial entrepreneurs Japan Airlines (日本航空株式会社) turnaround from bankruptcy Bad news from Japan’s electronics industry sector makes global headlines this week (I was interviewed on BBC, US National Public Radio etc) – in this newsletter, lets look at some good news from Japan. Kazuo Inamori (80 years old,…

-

How to turn Galapagos into a competitive advantage in both directions

Positive and negative aspects of Japan’s Galapagos issues European Institute of Japanese Studies Academy Seminars presents Speaker: Dr. Gerhard Fasol, President, Eurotechnology Japan K.K. Wednesday, June 13, 2012, 18:30 – 21:00 Embassy of Sweden, Alfred Nobel Auditorium Stockholm School of Economics, European Institute of Japanese Studies About the talk: In the last 20 years, several…