Category: disruption

-

Toshiba nuclear write-off. BBC interview about Toshiba’s latest nuclear industry write-offs

Toshiba is expected to announce write-off provisions on the order of US$ 6 billion today Toshiba is on Tokyo Stock Exchange warning list for possible delisting in March 2017 by Gerhard Fasol This morning 7:30am I was interviewed on BBC TV Asia Business Report about an update of Toshiba’s ongoing crisis, which has been 20…

-

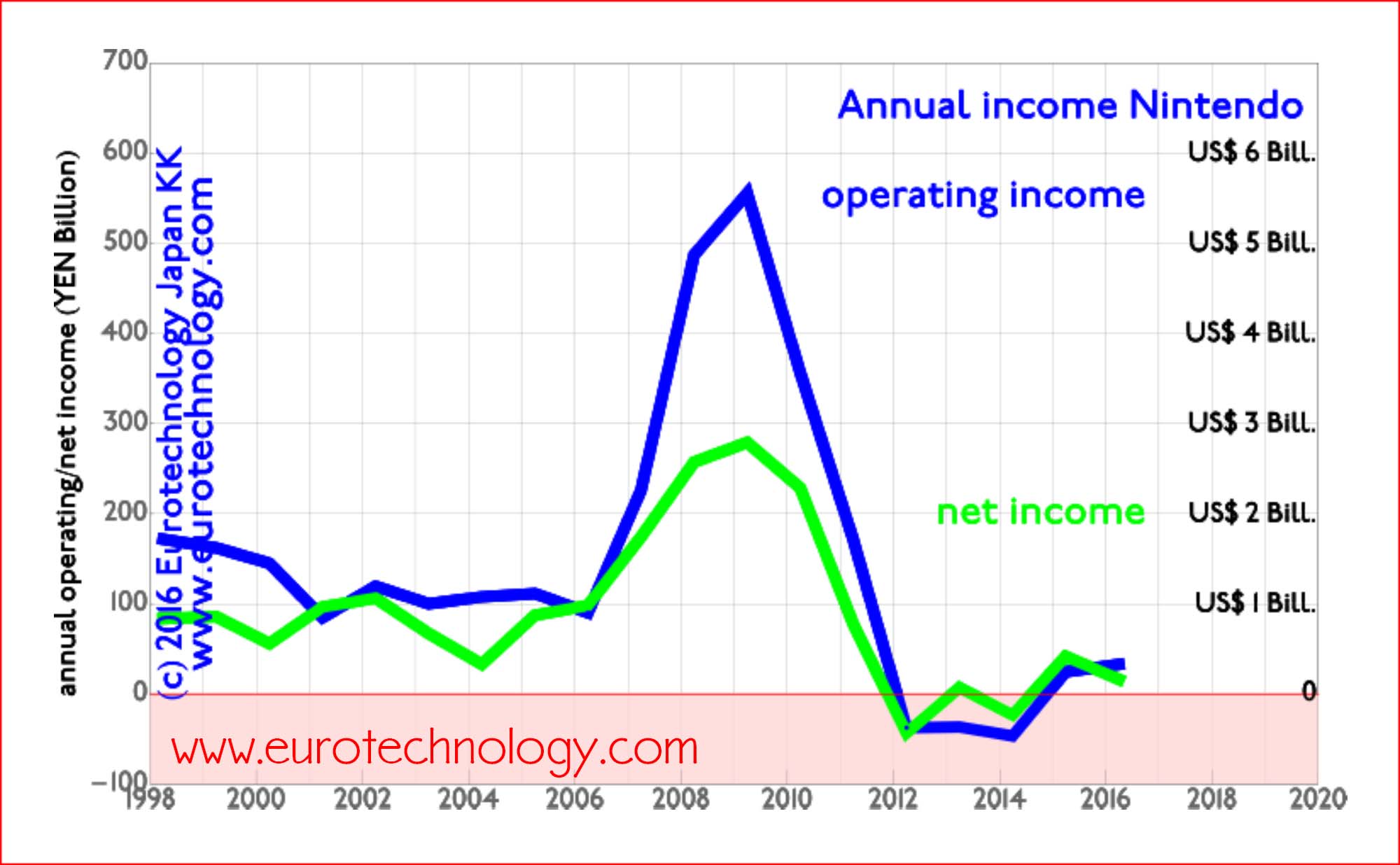

Pokemon Go – everybody loves Pikachu…

Pokemon Go is great – but will it bring another Nintendo boom as in 2009? or even exceed 2009? Google spin-out Niantic Labs’ augmented reality smartphone game booms to the top of charts Niantic Labs is specialized on augmented reality games. In a previous game, Ingress, players selected about 15 million memorable locations globally. Niantic…

-

Shuji Nakamura on 2nd and 3rd Generation Solid State Lighting

—

by

Shuji Nakamura’s invention to save energy corresponding to about 60 nuclear power stations by 2020 2nd and 3rd Generation Solid State Lighting For Shuji Nakamura’s invention of high-efficiency GaN double-heterostructure LEDs he was awarded the Nobel Prize in Physics 2014, while his employer sued him in the USA for leaking intellectual property – Shuji Nakamura…

-

Top-down vs bottom-up innovation: Japan’s R&D leaders at the 8th Ludwig Boltzmann Forum

How to fast-track innovation in Japan Shuji Nakamura’s invention of high efficiency LEDs enable us to reduce global energy consumption by an amount corresponding to 60 nuclear power stations by 2020, for which he was awarded the 2014 Nobel Prize in Physics. Still, a poster child for bottom-up innovation, Shuji Nakamura was sued by his…

-

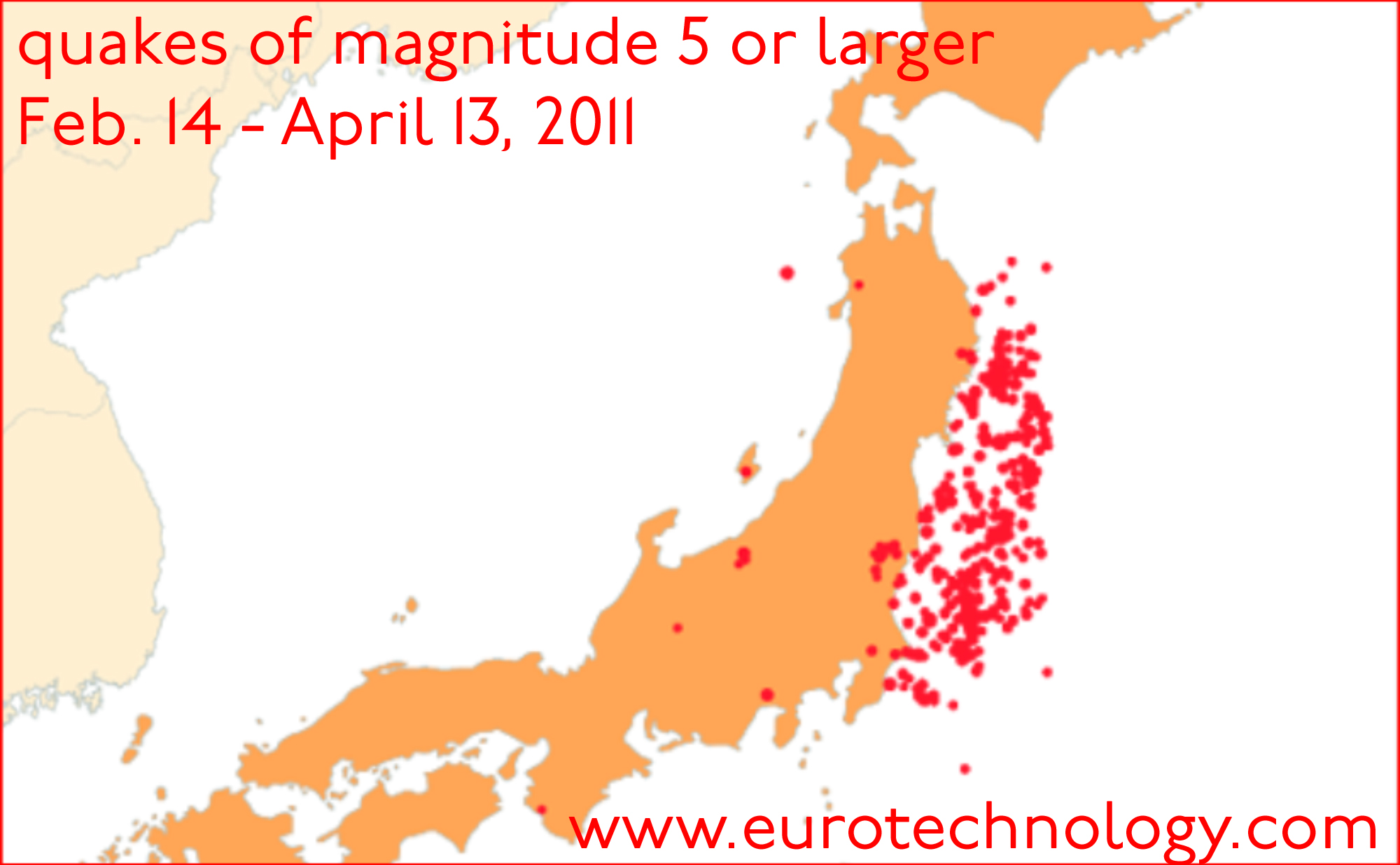

Fukushima nuclear disaster: 5 years since the Tohoku earthquake and tsunami on 2011/3/11 at 14:46:24

5 years and many lessons learnt since the Tohoku and Fukushima disasters Tohoku disaster and Fukushima nuclear disaster lead to Japan’s energy market liberalization Tohoku disaster: On Friday March 11, 2011 at 14:46:24, the magnitude 9.0 “Great East Japan earthquake” caused a tsunami, reaching up to 40.4 meters high inland in Tohoku. Japan’s National Police…

-

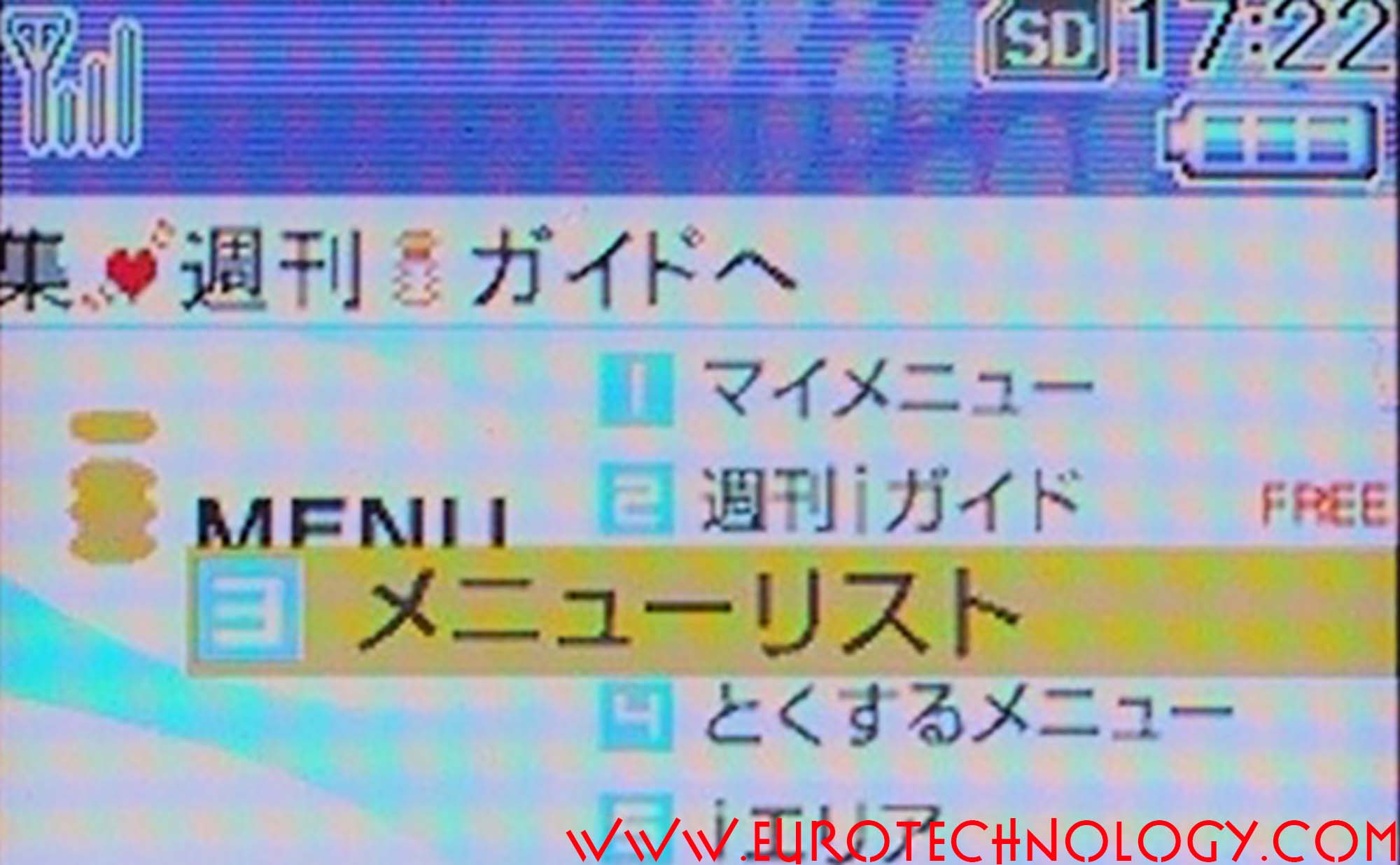

Mobile internet’s 17th birthday

The global mobile internet revolution started with Docomo’s i-Mode on February 22, 1999 i-Mode, Happy Birthday! Today, exactly 17 years ago, on February 22, 1999, NTT-Docomo launched the world’s first mobile internet service, i-Mode, at a press conference attended only by a handful of people. NTT-Docomo created the foundation of the global mobile internet revolution,…

-

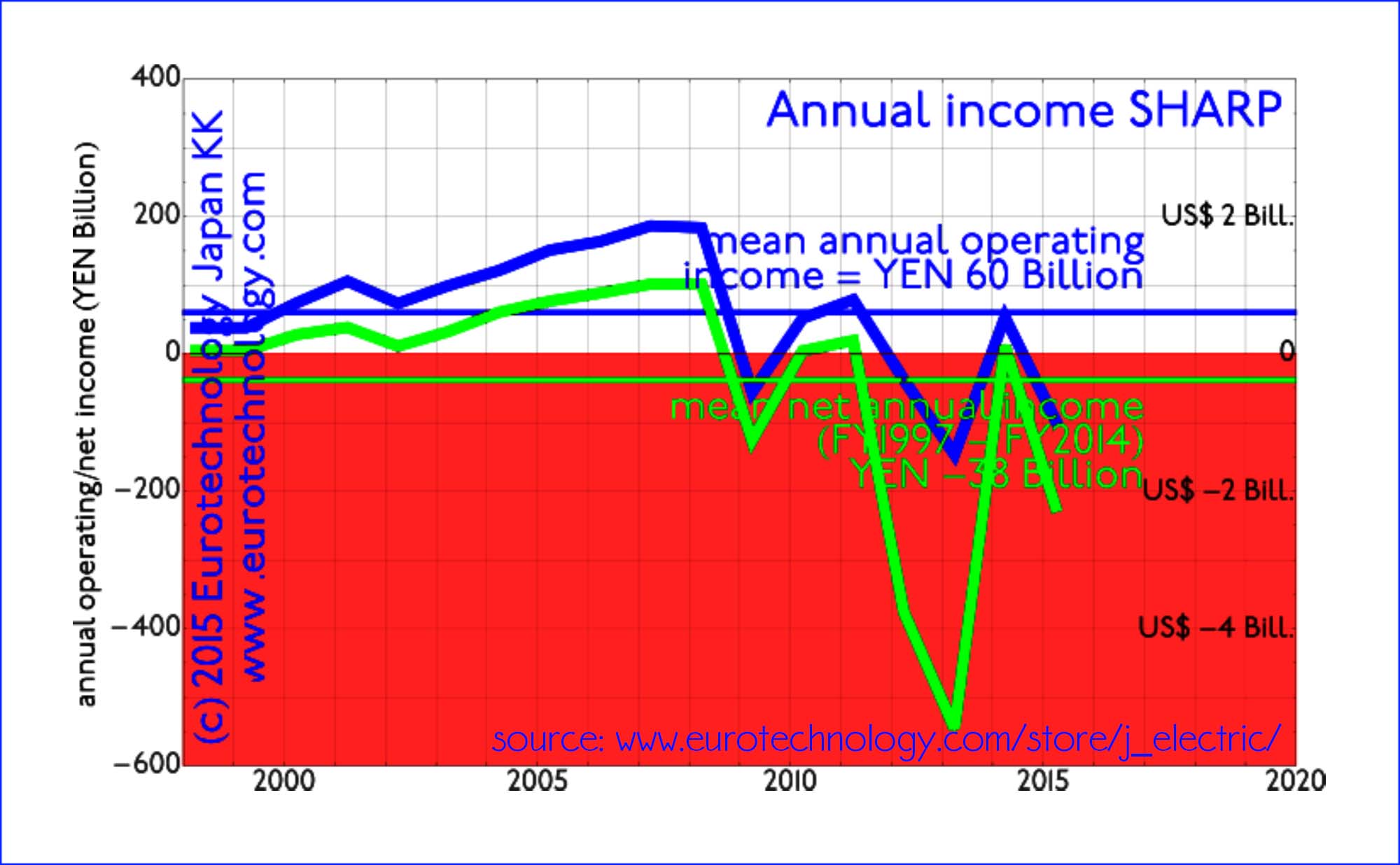

SHARP and the future of Japan’s electronics

SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector The need for focus and active portfolio management SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March. Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete…

-

Economic growth for Japan? A New Year 2016 preview

Economic growth for Japan in 2016? Economic growth: Almost everyone agrees that economic growth is preferred over stagnation and decline. Fiscal policy and printing money unfortunately can’t deliver growth. Building fresh new successful companies, returning stagnating or failed established companies back to growth (see: “Speed is like fresh food” by JVC-Kenwood Chairman Kawahara), and adjusting…

-

Was Osamu Suzuki first to understand Volkswagen’s Diesel issues?

Osamu Suzuki: “we looked at Wagen’s technologies, and could not find anything we need” (Nikkei, 1 July 2011) by Gerhard Fasol Did Volkswagen underestimate Mr Suzuki? Over the last 18 years myself and our company have worked on many foreign-Japanese company partnerships, therefore we always have great interest in business partnerships involving Japanese companies, and…

-

Burberry Japan: breaking up is hard to do

Burberry Japan pivots from successful partnership to direct business by Gerhard Fasol, All Rights Reserved. Sanyo Shokai pivots from Burberry to Mackintosh and other brands Burberry Japan pivots to direct business to solve Burberry’s “Japan Problem”: for the last approx. 50 years Burberry’s business in Japan was not Burberry’s business at all, but run under…

-

Nintendo smartphone pivot?!

Nintendo partners with DeNA Taking Nintendo intellectual property and characters to smartphones Nintendo was founded on September 23, 1889 by Fujasiro Yamauchi in Kyoto for the production of handmade “hanafuda” cards. Nintendo Headquarters are still located in Kyoto (you can see the Nintendo headquarters building from the Kyoto railway station). The Chinese characters used to…

-

i-Mode was launched February 22, 1999 in Tokyo – birth of mobile internet

The mobile internet was born 16 years ago in Japan Galapagos-Syndrome: NTT Docomo failed to capture global value On February 22, 1999, the mobile internet was born when Mari Matsunaga, Takeshi Natsuno and Keiichi Enoki launched Docomo’s i-Mode to a handful of people who had made the effort to the Press Conference introducing Docomo’s new…

-

Shuji Nakamura: did he invent the blue GaN LED alone and other questions. An Interview.

Interview for the Chinese Newspaper Southern Weekly about Shuji Nakamura by Gerhard Fasol The Chinese Newspaper Southern Weekly interviewed me about Shuji Nakamura’s invention of the blue LED and the background to his Nobel Prize. Here some of my answers. Read the article in Southern Weekly in Chinese language here: 【2014诺贝尔·科学】无人相信的发明 Shuji Nakamura: when he…

-

Shuji Nakamura, Isamu Akasaki, Hiroshi Amano win Nobel Prize in Physics 2014 for the blue LED

Nobel Prize in Physics 2014 for the blue GaN LED by Gerhard Fasol Shuji Nakamura, Isamu Akasaki, Hiroshi Amano enabled the global lighting revolution The Nobel Prize in Physics 2014 was awarded in equal shares to Isamu Akasaki, Hiroshi Amano and Shuji Nakamura “for the invention of efficient blue light-emitting diodes which has enabled bright…

-

Apple Pay vs Japan’s Osaifu-keitai – the precursor to Apple Pay

What can we learn from 10+ years of mobile payments in Japan? Apple Pay vs Japan’s Osaifu-Keitai: watch the interview on CNBC https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html?play=1 Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) Japan’s Osaifu keitai mobile payments started on July 10, 2004, after public testing during December 2003 – June 2004 Two different…

-

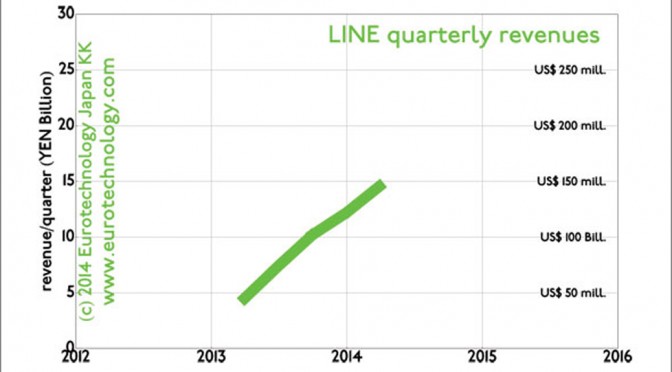

LINE revenues: LINE announces YEN 14.6 billion first quarter revenues

LINE revenues: LINE announced quarterly revenues on their website, the revenue data are redrawn below, with approximate US$ amounts shown as well. Extrapolating assuming continued linear growth, we can estimate expected annual LINE revenues of YEN 70 billion (US$ 700 million) for the full year 2014. Yesterday I was interviewed by Wall Street Journal about…

-

Flappy bird Angry Birds ultimate Japan game disruption: flappy bird flaps to the top

Flappy bird Angry Birds ultimate disruption: flappy bird effortlessly flaps to to the top of ranks, while Angry Birds are watching angrily from the sidelines Disruption of Japan’s games sector: in a previous blog post we showed that just three newcomers (Gree + DeNA + Gungho) produce more profits than the top 9 traditional game…

-

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…

-

Financial instability of Japan’s electricity companies started in 2007

Financial instability of Japan’s electricity companies started long before the Fukushima nuclear accident Japan’s electricity companies ran into financial instability long before the March 11, 2011 disaster It is often assumed that the financial difficulties of Japan’s electricity companies are caused by the shut-down of almost all Japanese nuclear power stations within 13 months of…

-

![Fukushima disaster impact on Tokyo [5]: Radiation risk situation for Tokyo, Business risk impact](https://www.eurotechnology.com/b/wp-content/uploads/2011/04/quakes_map_825_510.jpg)

Fukushima disaster impact on Tokyo [5]: Radiation risk situation for Tokyo, Business risk impact

5th update on the crisis in Tokyo, focusing on radiation and business impact Fukushima nuclear accident impact on Tokyo, 12 April 2011 This is our 5th update on the crisis in Tokyo, focusing mainly on the radiation and impact on business in Japan. The continuing quakes (as shown below) do present risk. To my knowledge,…

-

New Japan vs old Japan: Japan’s two worlds

Japan’s two worlds New Japan vs Old Japan A few days ago the New Context Conference was held here in Tokyo, mainly about social network systems (SNS), top executives including CEO of LinkedIn, Facebook, and some exciting new photo, video conference and e-learning companies discussed market entry to Japan. Japan’s two markets Takeshi Natsuno, one…