Corrections amount to 2 1/2 years (31.5 months) of average annual net profits

Sales stagnation combined with almost zero net profit of Japan’s top 8 electronics companies creates increasing pressure to improve performance: top 8 electronics groups stagnate while Japan’s top-7 electronics parts makers thrive

Toshiba over the last few weeks published a number of announcements, and corrections to these announcements concerning accounting issues. Toshiba also engaged internal and independent external expert commissions to analyze possible accounting discrepancies, these committees have made preliminary announcements.

At a recent Press Conference, the CEO of the Japan Exchange Group (JXP) which includes the Tokyo Stock Exchange, Mr Atsushi Saito, said that “he feels very much ashamed for Toshiba”, and that “he cannot understand how Toshiba can be so lazy about their accounting”.

To understand Toshiba in the context of Japan’s electronics industry, read our report on Japan’s electronics industry sector:

Toshiba in the context of Japan’s electronics industry sector: top-8 electronics groups stagnate while electronics parts makers thrive

Japan’s top-8 electronics giants – including Toshiba – have essentially stagnated for the last 17 years with negligible growth and negligible profits. Japan’s top 8 electronics groups combined have sales approximately as large as the economy of The Kingdom of the Netherlands. However, the big difference is, that in the 17 years since 1998, the economy of The Netherlands has approximately doubled, while Japan’s top 8 electronics companies have not grown their sales at all over these 17 years. Expressed in Japanese YEN, the combined sales of Japan’s top 8 electronics companies in FY1998 is about the same as in FY2014.

Japan’s electronics parts makers are a very different story: similar to The Netherlands, Japan’s top-7 electronic parts makers have grown to more than twice the size over the 17 years from FY1998 to FY2014. Some of the Japanese electronics parts makers have growth targets which should allow them to overtake Japan’s current incumbent electronics groups!

To understand Japan’s electronics sector, read our report.

The stagnation of sales growth combined with almost zero profits over 17 years of Japan’s top 8 electronics groups, of which Toshiba is one, certainly puts much pressure on Japan’s electronics groups to improve performance. This pressure might be the background of accounting issues.

Lets look at the actual Toshiba financial data in detail

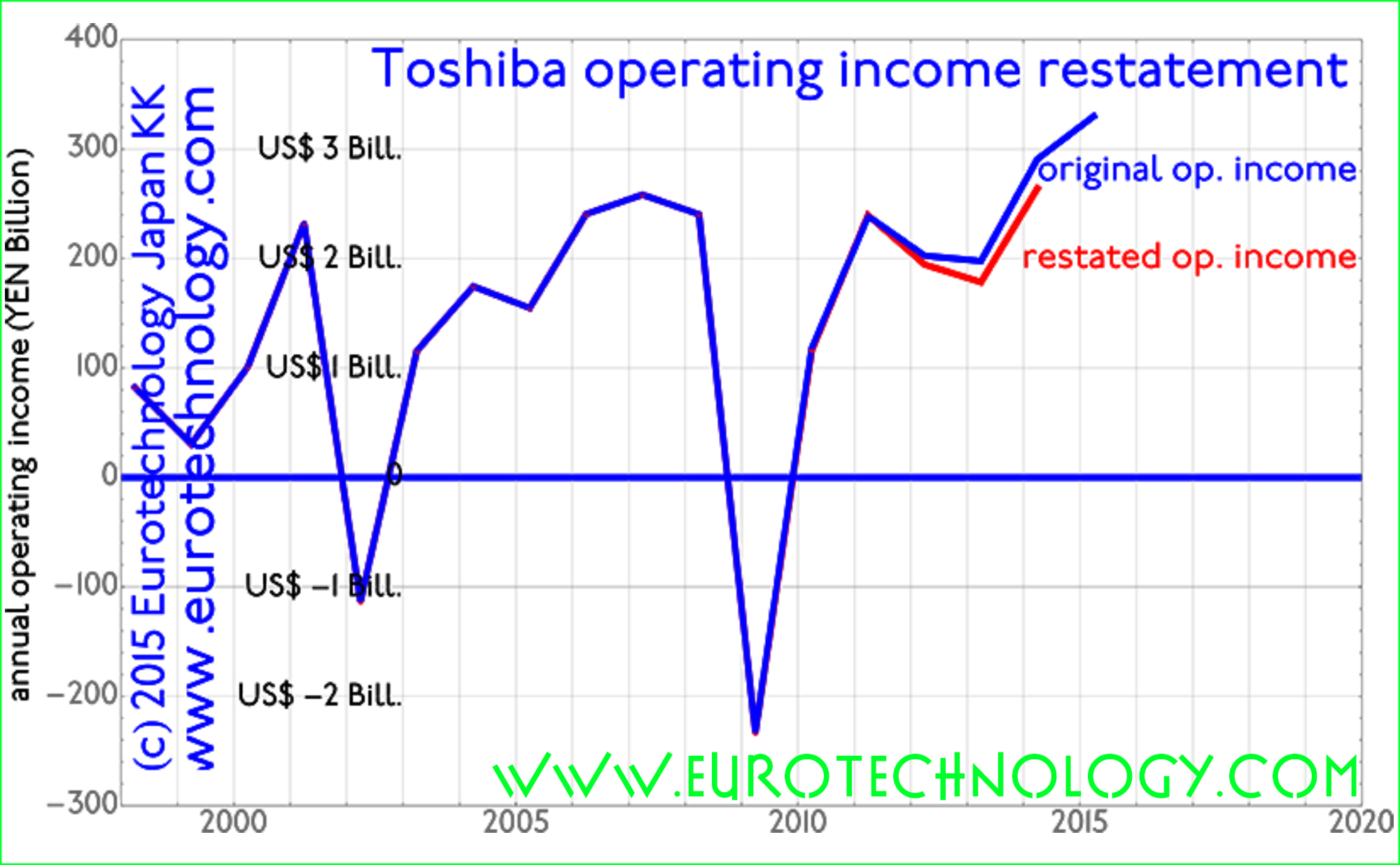

The figure below shows Toshiba’s previously reported operating income/profits (blue curve), and the recently announced preliminary corrections (red curve). The combined amount of downward corrections is about YEN 50 billion (US$ 0.5 billion) in total.

Lets put this amount into context (financial data from our Report on Japan’s electronics industries):

- annual sales: approx. YEN 6000 billion (US$ 60 billion)

- annual operating income (average over last 17 years): YEN 148 billion (US$ 1.5 billion)

- annual net income (average over last 17 years): YEN 19 billion (US$ 190 million)

Therefore the downward correction corresponds to:

- approx. 0.8% of average annual sales

- approx. 33% of average annual operating profits

- approx. 2 1/2 years (31.5 months) of net profits

Toshiba – typical for Japan’s large electronics corporations – operates with razor-thin profit margins: Toshiba’s net profit margin averaged over the last 17 years is 0.25%.

Therefore, the downward correction corresponds to 31.5 months of average net income/profits.

Toshiba accounting corrections amount to approx. 33% of average annual operating income

Japan electronics industries – mono zukuri – report

Copyright (c) 2015-2019 Eurotechnology Japan KK All Rights Reserved-2019

Comments and discussions