Many press articles get SoftBank market share in Japan wrong

With SoftBank‘s acquisition of US No. 3 mobile operators Sprint and the possibility that Softbank/Sprint will also acquire No. 4 T-Mobile-USA, SoftBank and Masayoshi Son are catching global headlines.

SoftBank market share in Japan: Many media articles report wrong data, because they forget to include group companies

- “SoftBank $73 Billion Payoff Fuels Japan Startups Push” Bloomberg, March 19, 2014

- “SoftBank warns of less profitable year ahead”, Financial Times, May 7, 2014

- “Japan Billionaire Son Invokes Do-or-Die Spirit in SoftBank U.S. Push”, BloombergBusinessweek of May 12, 2014

These articles state SoftBank’s market share in Japan’s mobile market as 25% and say that KDDI Group has more subscribers than Softbank Group in Japan, but is this really true?

What is SoftBank‘s true market share in Japan’s mobile communications markets?

Detailed subscriber data and analysis of Japan’s telecom markets in our Report on Japan’s telecom sector.

SoftBank recently acquired eMobile/eAccess, and has been the court-appointed reconstruction partner of Willcom, after Willcom’s financial failure. Therefore eMobile/eAccess and Willcom are also part of the SoftBank group, and SoftBank plans to merge both. In addition, Wireless City Planning (WCP) are also part of the SoftBank group. You will find these transactions, the logic and reasoning behind them explained in great detail in our reports on SoftBank and on eAccess/eMobile.

List of mobile operators on Japan’s market today:

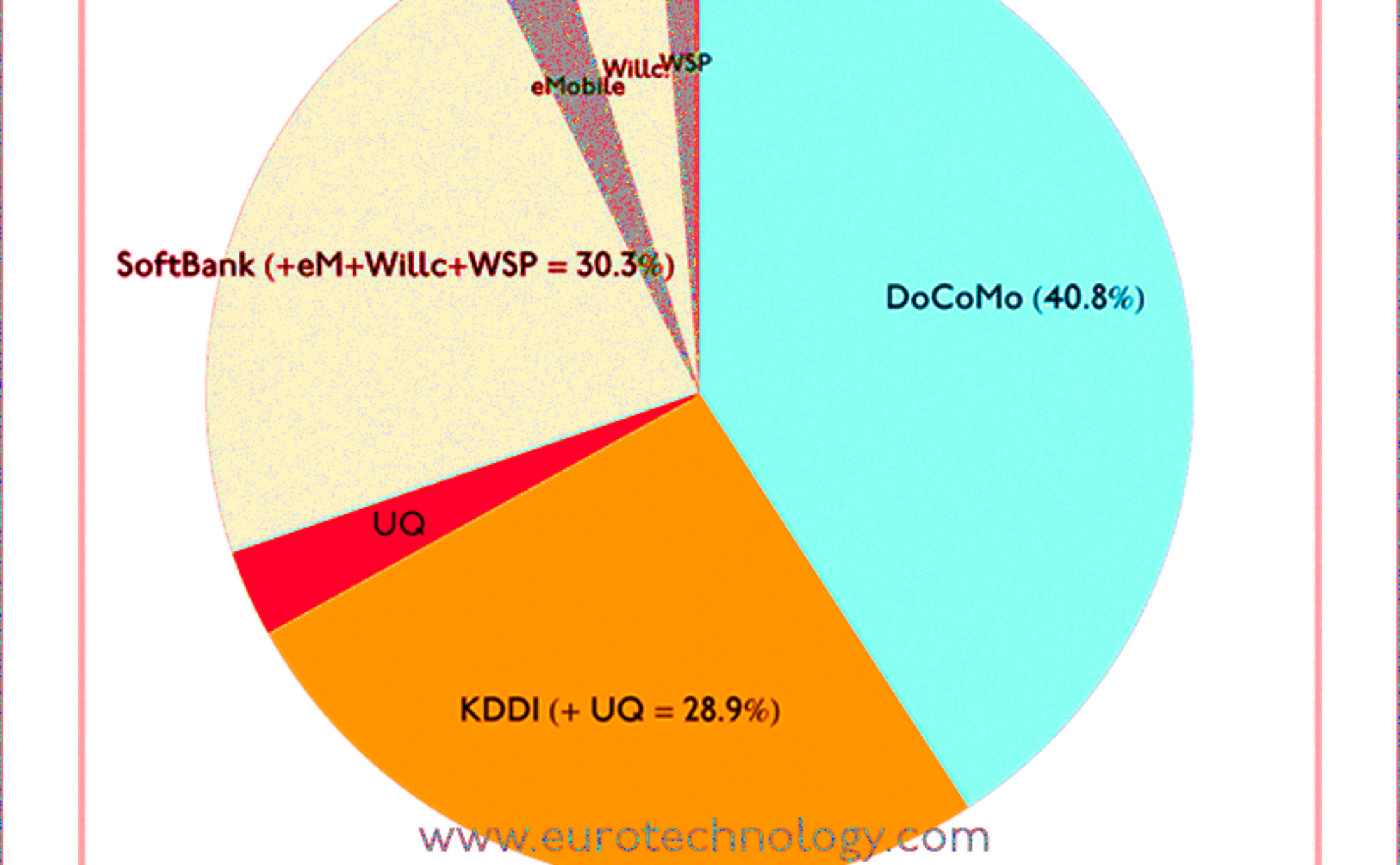

We have the following mobile operators currently in Japan – subscription market shares are shown in brackets (subscriber numbers for Docomo, KDDI and Softbank are as of February 28, 2014, while for other operators the latest officially reported numbers are used):

- NTT Docomo Group (40.8%)

- KDDI Group (28.9%)

- AU

- UQ Communications

- fixed line and other businesses

- SoftBank Group (30.3%)

- SoftBank

- eMobile/eAccess (note: eMobile, eAccess and Willcom are now combined into Ymobile)

- Willcom (now merged into Ymobile)

- Wireless City Planning (WCP)

- fixed line and other businesses

- several virtual mobile operators, e.g. Japan Communications Inc. who lease communications capacity e.g. from Docomo and retail this leased capacity to their own subscribers

The SoftBank group including eAccess/eMobile, Willcom and Wireless City Planning has actually more than 30% of Japan’s mobile subscriber market – not 25% as some articles write.

For detailed market data, statistics and analysis of Japan’s highly competitive mobile communications market, read our market report on Japan’s telecom markets, which includes analysis and data for Japan’s wireless, fixed, ADSL and FTTH markets, and detailed financial data, analysis, and comparison of the financial performance of NTT, NTT Docomo, SoftBank and KDDI.

We are also preparing reports on Japan’s cloud and data center markets –

Learn more about SoftBank, Masayoshi Son, and his 30/300 year vision for SoftBank

Copyright (c) 2014 Eurotechnology Japan KK All Rights Reserved ;

Comments and discussions